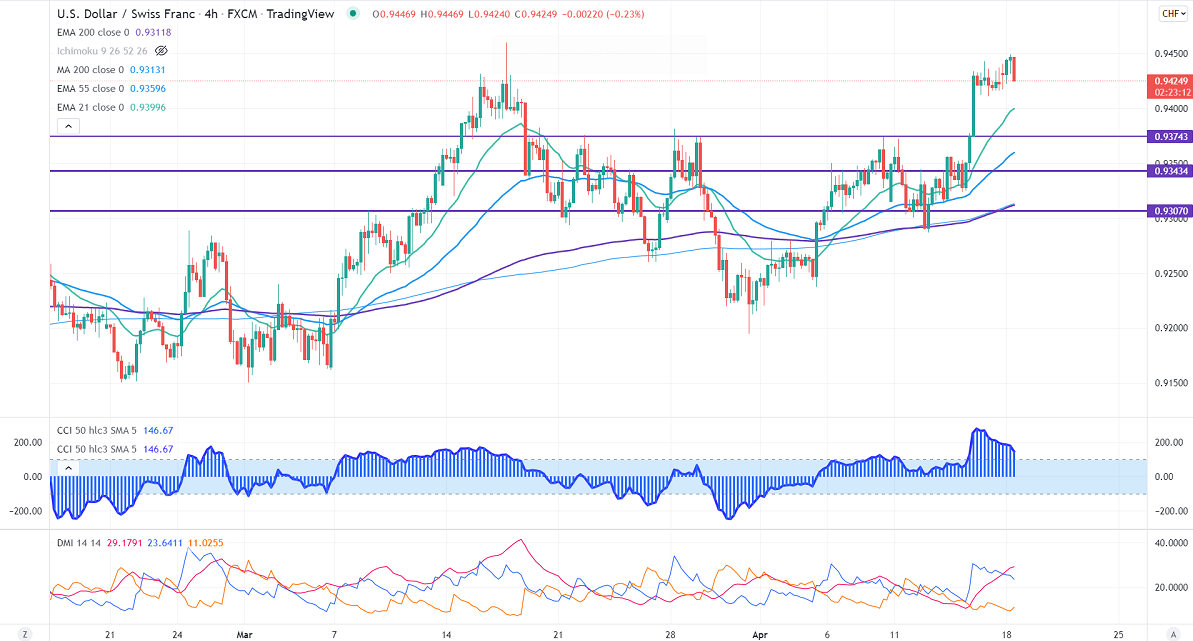

Major resistance- 0.9460

The pair breaks significant resistance 0.93850 and hits the highest level since Mar 17th, 2022. The surge in US inflation has increased the chance of a 50 bpbs hike in the next meeting during May month. According to the CME Fed watch tool, the probability of a 50 bpbs rate hike in May increased to 91.05 %. USDCHF hits an intraday high of 0.94488 and is currently trading around 0.94340.

Bullish scenario-

The primary level to Watch – is 0.9460. Any convincing surge above confirms intraday bullishness. A jump to 0.9500/0.9520 is possible.

Bearish scenario-

Intraday support – 0.9380. Break below that level will take the pair to 0.9340/0.9300.

Indicators (4-Hour chart)

Directional movement index – Bullish

CCI (50) - Bullish

It is good to buy on dips around 0.9400 with SL around 0.9340 for a TP of 0.95000/0.9520.