USDCHF continues to trade lower after a minor pullback to 0.96877. Markets eye US Fed chairman Powell's speech at the Jackson hole symposium for further direction. US new orders for manufactured goods came flat compared to a forecast of 0.90% While core durable goods orders rose by 0.30%in July. The US pending home sales dropped for the sixth time this year and slipped 1% in Jul.

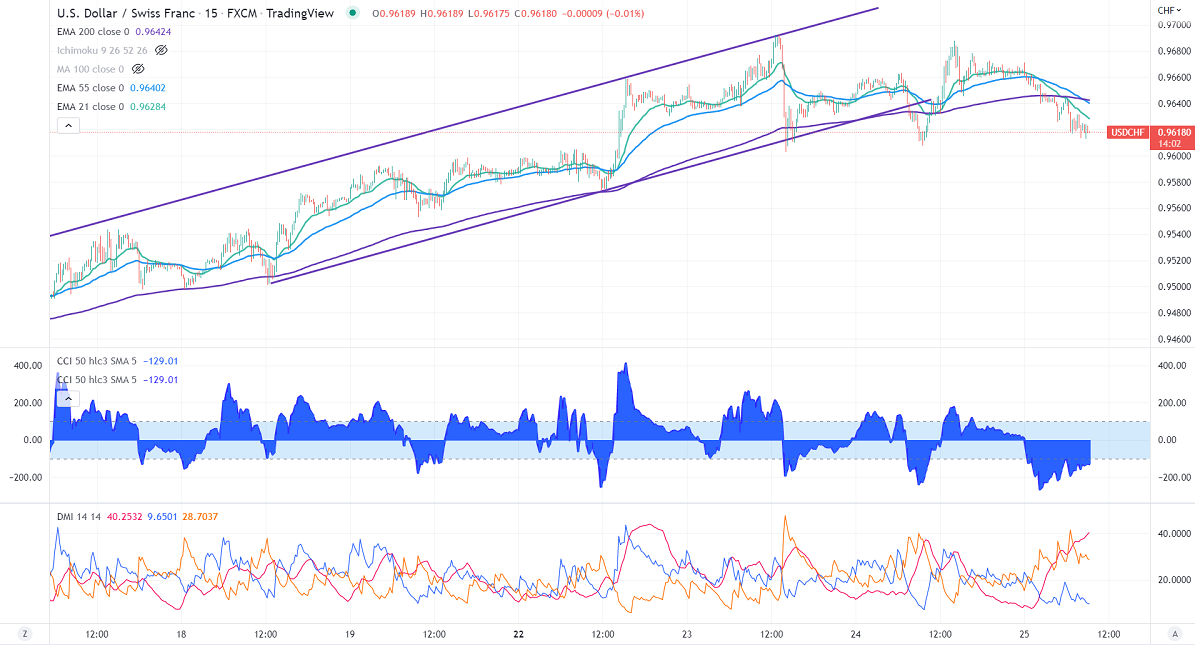

Technically in the 15 min chart, the pair is holding below short term (21- and 55 EMA) and 200 EMA (0.96429). Any break above 0.96625 will take the pair to 0.9700/0.9765/0.9800. USDCHF hits an intraday low of 0.96130 and is currently trading around 0.96191.

The near-term support is around 0.9600, any breach below targets 0.9540/0.9500/0.9470.

Indicators (15-Min chart)

CCI (50)- Bearish

ADX- bearish

It is good to sell on rallies around 0.9648-50 with SL around 0.9700 for TP of 0.9570/0.9540.