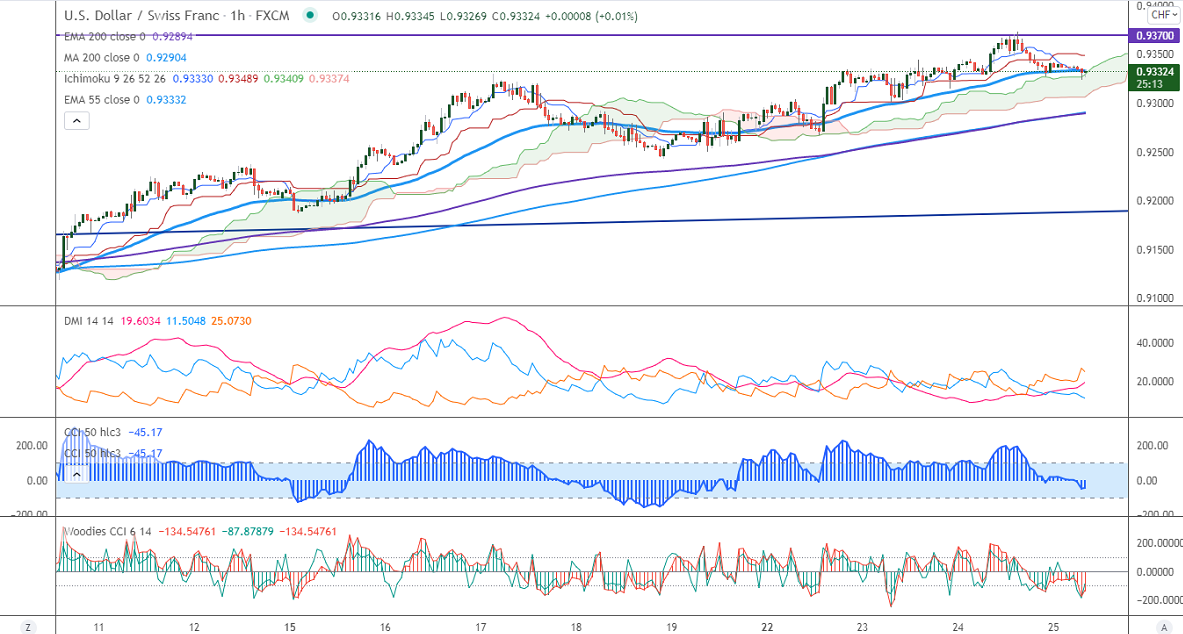

Intraday trend – Neutral

Major intraday resistance – 0.9380

The pair has formed a double top around 0.93750 and has shown a minor decline. USDCHF was one of the best performers in the past three weeks and surged more than 200 pips on board-based US dollar buying. US personal income jumped to 0.50% and the headline PCE surged 5.0% YOY above expectations of 4.6%. US real GDP came at 2.1% in Q3 at annualized rate vs. an estimate of 2.2%. 0.9300. Significant bullish trend continuation if it breaks 0.9380 levels.

The near-term resistance is around 0.9380, any breach above 0.9380 confirms further bullishness. A jump to 0.9435/0.9500 is possible.

The minor support to be watched is 0.9270; the violation below will drag the pair down till 0.9240/0.9200.

Indicators (1 Hour chart)

Directional movement index – Bearish

CCI (50) - Bearish

It is good to buy above 0.9380 with SL around 0.9330 for a TP of 0.9500.