Since the implied volatility of USDCHF is perceived to be minimal, so here comes a multiple leg of option strategy for regular traders of this currency cross when there is little IV. A total of 4 legs are involved in the condor options strategy and a net debit is required to establish the position.

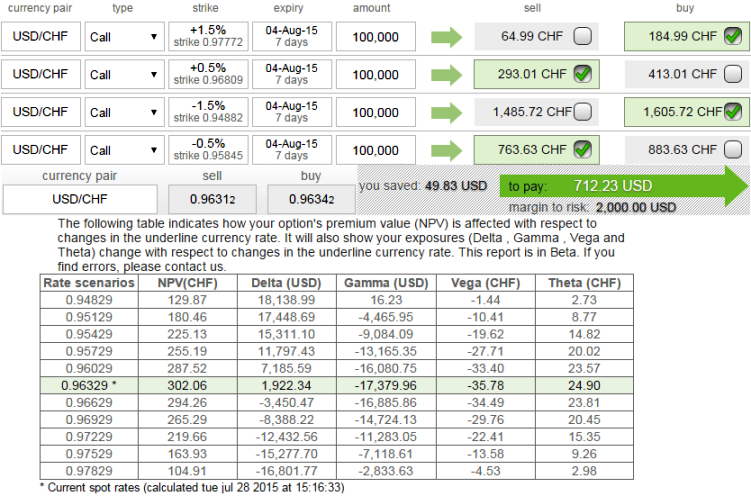

The trader can construct a long condor option spread as follows, as shown in the figure; the trader can implement this strategy using call options with similar maturities.

So strategy goes this way, writing 7D (-0.5%) In-The-Money call and buying deep striking (-1.5%) 0.84 delta In-The-Money call, writing a higher strike (0.5%) Out-Of-The-Money calls and buying another deep striking (1.5%) Out-Of-The-Money 0.17 delta call for a net debit.

Maximum returns for this strategy is achievable only when the exchange rate of USDCHF falls between the 2 middle strikes at maturity. It can be derived that the maximum profit is equal to the difference in strike price of the 2 lower striking calls less the initial debit taken to enter the trade.

FxWirePro: USDCHF low implied volatility portrays hedging with condor spreads

Tuesday, July 28, 2015 9:56 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate