CAD sharply depreciated by as much as 4.8% from mid-April highs on a layering of multiple concerns that suddenly gathered around Canada. These risks include fresh concerns over the US-Canada trade relationship, the potential for sharply lower oil prices, and the re-emergence of housing market related financial stability vulnerabilities.

While all of these developments could potentially impart a significant negative shock to the Canadian economy and thus the currency, none of these risks have been realized yet, nor are they necessarily acute.

The lumber tariff was mostly an idiosyncratic sideshow, and NAFTA renegotiation risks are still poorly defined and medium-term, not acute.

As we discussed in a recent note, Trump Trade Policy and Canada: Signal or Sideshow?, the US-Canada lumber dispute has been ongoing for decades, the US trade enforcement action should have been well anticipated, and therefore should not be read necessarily as a signal about how the broader US-Canada trade relationship will play out.

Instead, NAFTA uncertainty remains low-grade and medium-term (the administration has not even formally started the renegotiation process, which is awaiting the confirmation of the USTR).

Costless collars to hedge aggressive bullish outlook

The nutshell above explains that hedgers’ interests have been neutral but upside risks are lingering, however, no new shift in sentiments are observed. As a result, we don’t see much traction OTM calls.

More broadly, with the post-referendum upsurge in uncertainty proving short-lived, the main drag on the economy is now expected to come through the hit to consumer purchasing power resulting from the weakness of sterling, with the bulk of the impact due to take effect in 2017.

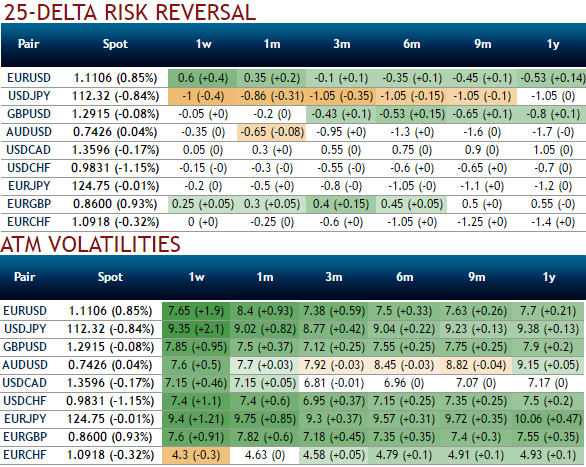

In the recent times, CAD vols skews destabilized too much especially on crude’s price sustainability, while USD volatility market normalized sharply (you could be observed that in USDCAD IV skews) which has been well balanced on both the sides. The liquidity recovered and the extreme positioning was ultimately absorbed. The price action is not taking the direction of an imminent new trend. As a result, the options market aggressively unwound smile positions.

Contemplating major trend and short-term upswings, anyone who wishes to carry long USDCAD exposures, a collar options trading strategy is recommended. This could be constructed by holding the total number of units of the underlying spot FX while simultaneously buying a protective put and shorting call option against that holding. The puts and the calls are both OTM options having the same expiration month and must be equal in the number of contracts.

The collar is a good strategy to use if the options trader is writing covered calls to earn premiums but wish to protect himself from an unexpected sharp drop in the price of the underlying security.

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays