Following the UK’s revised Brexit proposals being submitted to the EU, the market will continue to gauge the prospect of an agreement being reached by the EU Summit on the 17/18 October. While the government appeared to be more positive, they received a cool response from the EU. However, the plans were not dismissed out of hand, meaning that they are expected to form the basis of intensive negotiations over the coming week to ten days.

Over the weekend, UK PM Boris Johnson reiterated his pledge to take the UK out of the EU on 31st October, with media reports suggesting that he is prepared to launch legal action in his attempt to make sure that the UK can leave with no deal.

GBP has now outperformed month-to-date within G10, but our outlook is consistent with weaker levels. The outperformance had come about amid reduced odds of a “no deal” (and some optimism on a deal occurring) by the end of October, which still elicited a market response given crowded investor shorts.

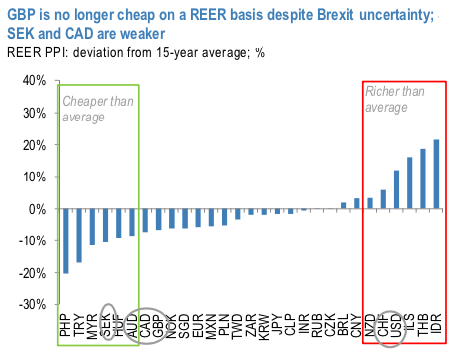

As a result, GBP valuations are not cheap any longer, having strengthened by 3% in TWI terms since mid-August—on a REER basis, SEK and CAD screen cheaper than GBP (refer above chart).

However, our base case as outlined by J.P. Morgan economists is less optimistic, specifically that:

i) the odds of a deal by 31st October are very low given the lack of alternative arrangements to the Irish backstop that would be acceptable to the EU and a compressed timeframe, and ii) beyond that, the odds of hard Brexit/ no deal around the January deadline have actually increased given recent polls that indicate that the lead of Tories vs. Labour has been relatively stable despite recent events and still suggest on margin a Conservative majority in the elections.

Against this backdrop—not-so-cheap valuations, ongoing political uncertainty with risks of “no deal” still lingering and a more dovish BoE—we view risks to GBP tilted to the downside as well in the near-term and recommend re-selling GBP vs. CHF outright. The immediate catalysts to watch are the Conservative Party conference over the weekend which clearly takes on additional significance as it will shed more light on possible UK proposals. But we doubt that there will be any additional substance to imply a breakthrough. Upcoming polls will be important to track as well as they will indicate if the recent dramatic turn of events has affected the support for Tories.

Trade tips:

Initiated shorts in GBPCHF outright at 1.22 on September 27th. Stop at 1.2450. Marked at -0.21%.

Stay short a 2M GBPUSD 1.1950/1.15 bear put spread at the beginning of August. Paid 0.66%. Marked at 0.00%. Courtesy: JPM

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed