The Brexit dust is still not settled as the UK Prime Minister May addressed Parliament, providing an update on what could occur this week. May indicated that there is not enough parliamentary support for a third attempt at passing a meaningful vote on the deal negotiated with the EU. Even so, another vote has not been ruled out, with May still hoping to garner support.

This week, Parliament will hold another set of indicative votes on various Brexit options, but the Government has stated that it will not necessarily implement what – if anything – Parliament supports, with the Prime Minister suggesting that she wouldn’t accept a customs union membership. Meanwhile, the EU has upped its preparations for a hard Brexit, which it described as “increasingly likely”.

GBPJPY has rallied from the lows of 143.723 to the recent highs of 148.874 levels, which must have been factored in our previous strategy through the short leg of OTM puts. Yes, We have advocated put ratio back spreads of diagonal tenors a few days ago that comprised of shorts in 2w (1%) OTM put option (position seemed when the underlying spot goes either sideways or spikes mildly), simultaneously, longs in 2 lots of long in 2m ATM -0.49 vega put options.

As the underlying spot FX has spiked considerably as stated above, the writer of the short legs can rest assured with initial premiums received.

The rationale for long legs in PRBS: The positively skewed IVs of 2m tenors signify the hedgers’ interests to bid OTM put strikes up to 141 levels (refer above nutshells evidencing IV skews).

Accordingly, long positions in the diagonal put ratio back spreads (PRBS) have been advocated on the hedging grounds. Both the speculators and hedgers who are interested in bearish risks are advised to capitalize on abrupt and momentary price rallies, simultaneously, bidding theta shorts in short run, on the flip side, 2m skews to optimally utilize vega longs.

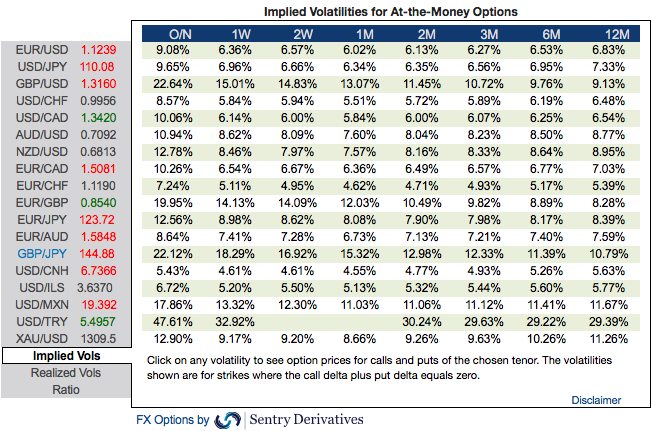

The volatility impact: Please be noted that 1m IVs of GBPJPY display the highest number (15.32%) among the entire G10 FX universe (trending between 12.23% - 14.69%). Hence, vega long put is most likely to perform decently capitalizing on the rising mode of IVs.

The traders tend to perceive these trades as a bear strategy because it deploys more puts. But actually, it is a volatility strategy.

Hence, entering the position when implied volatility is high and anticipating for the inevitable adjustment is a wise thing, regardless of the direction of price movement. Based on volatility and time decay, the strategy is a “price neutral” approach to options and one that makes a lot of sense.

Given the condition that IVs keep rising and if GBPJPY spot keeps dipping, then the vega longs would add handsome option’s premiums to the price of such puts correspondingly, these derivatives instruments target further bearishness of this pair. Courtesy: Sentrix and ANZ

Currency Strength Index: FxWirePro's hourly GBP spot index is flashing -82 (which is bearish), while hourly JPY spot index was at 148 (bullish) while articulating (at 08:06 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025