After reaching as high as $72.9 per barrel, WTI has declined steadily to $64.5 per barrel as of today. While the selloff was triggered by Saudi Arabia and Russia announcing that they are considering an increase in the production cap by a million barrels per day, it is not the only and major factor pushing the WTI crude lower. The much higher Brent crude price ($74.3 per barrel) and its much smaller decline ($6.1 per barrel compared to WTI’s $8.4 per barrel) indicate that way.

The major factor for WTI’s additional decline has been the local crude supplies and the continued geopolitical/geological bottlenecks between U.S. refineries and production sites. So far, in 2018, the U.S. crude oil production has increased by almost a million barrels per day.

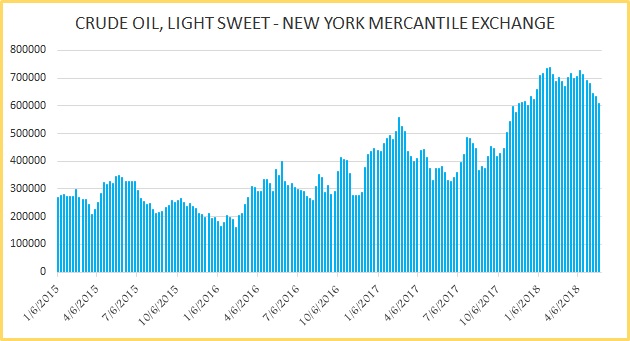

Our calculations suggest that while WTI has corrected more than 10 percent, it is likely to decline further, as the hot money from hedge funds flow out. The chart shows, speculative position in WTI based on the Commitment of Traders (COT) report. Since bottoming in January 2016, the speculative positions rose from +163.5K contracts to a record high of +739.1K contracts as of February this year. Since then the speculative longs have steadily declined and was +607.8k contracts of the end of May 2018.

We expect the speculative positions to decline further along with a decline in WTI towards $53 per barrel area.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed