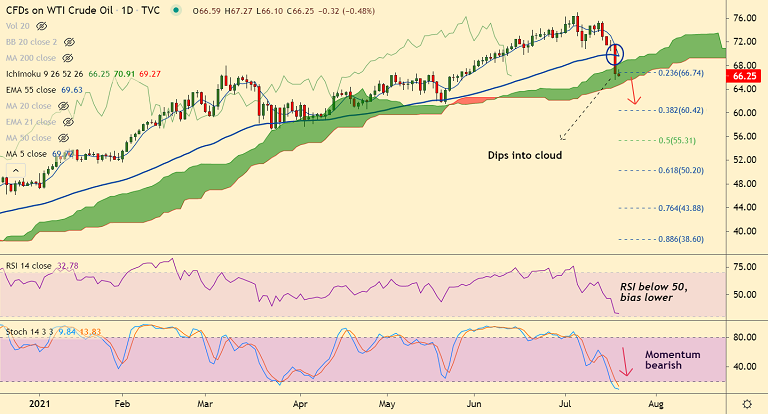

USOIL chart - Trading View

WTI crude oil was consolidating previous session's slump with session high at 67.27 and low at 66.10.

Price action was rangebound after previous session's slump and traders await API inventories data for impetus.

On Monday, WTI tumbled as much as 7.5% after deal reached amongst OPEC and its allies (OPEC+) to ramp up oil supply triggered sell-off.

Souring sentiment amid heightened fears that the accelerated spread of the Delta variant will derail the global economic recovery keep oil markets under pressure.

Technical bias remains bearish. Price action dips into daily cloud. Stochs and RSI are sharply lower. MACD and ADX also support weakness.

Recovery attempts lack traction. The pair is finding some support at 21-week EMA at 66.03. Break below to drag prices lower.