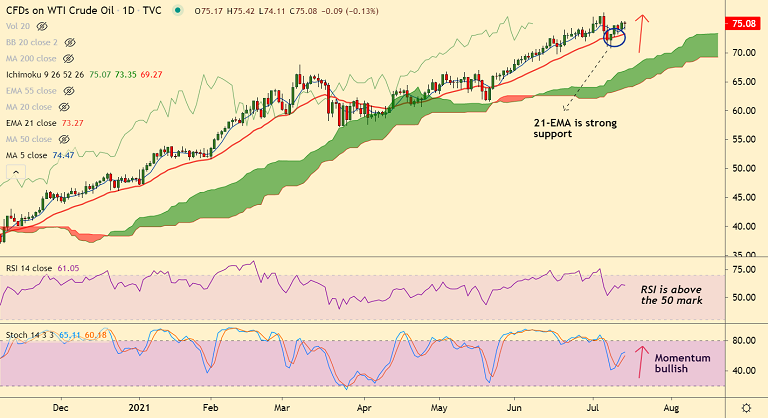

USOIL chart - Trading View

WTI retakes $75 mark despite risk-off mood as concerns over a tighter market amplified on OPEC+ impasse and falling US crude inventories.

On Tuesday, the American Petroleum Institute (API) data showed the US crude inventories fell by 4.1 million barrels for the week ended July 9.

West Texas Intermediate prices are extending upside after bounce off 21-EMA support.

Oil price was trading at $75.07 at around 13:10 GMT, retracing from session lows at $74.11.

Markets await the US weekly crude stockpiles report due to be published by the Energy Information Administration (EIA) on Wednesday.

Major trend is bullish and intraday bias has also turned bullish. 5-DMA is now biased higher, scope for upside resumption. Bearish reversal only below daily cloud.