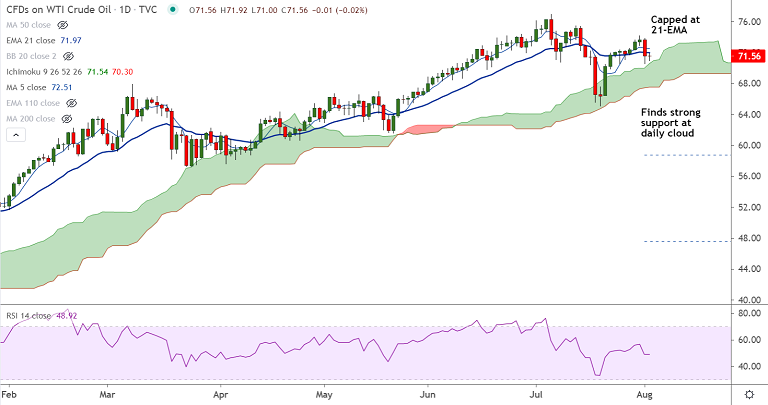

USOIL chart - Trading View

US oil remains sidelined after previous session's rout. Recovery attempts remain capped at 21-EMA.

WTI marked the biggest daily losses in two weeks on Monday, amid virus-influenced economic concerns.

Further, slowing factory activity in key markets weighed on sentiment. Disappointing July’s activity numbers from US and China raised questions over the recovery.

Crude oil prices failed to hold onto an early bounce on Tuesday, and were trading largely unchanged at $71.59 a barrel at around 10:30 GMT.

Technical bias remains neutral, with scope for upside resumption as long as price holds above 55-EMA and daily cloud support.

Inventory figures from the American Petroleum Institute (API) will be the key data to watch for trading impetus.

U.S. crude and product inventories likely declined last week with both distillates and gasoline stockpiles predicted to have fallen for a third straight week,

A preliminary Reuters poll showed on Monday that U.S. crude and product inventories likely declined for a third straight week last week (prior -4.728M).

Break below 55-EMA and dip into daily cloud could see dip till 110-EMA at 66.48. Bounce off daily cloud will negate any bearish bias.