Technical Analysis:

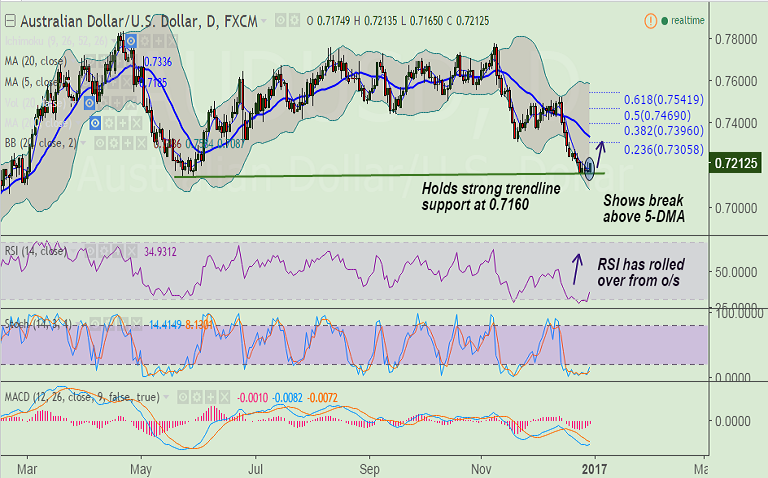

- AUD/USD has paused downtrend from 0.75 levels (Dec 14).

- The pair is extending sideways along major trendline support at 0.7160.

- Multiple rejections seen at trendline support (0.7160), weakness only on break below.

- RSI has shown a rollover from oversold levels.

- Price action moving away from lower bollinger band.

- Stochs are at oversold and rollover will add to bullish confirmation.

Fundamental Factors:

- Higher copper and iron-ore prices bolsters bids for the commodity-currency.

- Broad-based dollar weakness could add support.

Important Levels:

- Support: 0.7186 (5-DMA), 0.7160 (major trendline), 0.7148 (May 30 low)

- Resistance: 0.7258 (Dec 22 high), 0.7305 (23.6% Fib), 0.7336 (20-DMA)

FxWirePro Currency Strenght Index: FxWirePro's Hourly AUD Spot Index was at 1.48037(Neutral), while Hourly USD Spot Index was at -44.5926 (Neutral) at 0845 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Recommendation: Good to go long on close above 5-DMA at 0.7186, SL: 0.7150, TP: 0.7250/ 0.73/ 0.7330

FxWirePro: Watchout for AUD/USD close above 5-DMA at 0.7185 for upside potential

Thursday, December 29, 2016 9:04 AM UTC

Editor's Picks

- Market Data

Most Popular