Bearish GBPAUD scenarios below 1.76 areas given:

1) The BoE passes on a May hike;

2) Core UK CPI continues to moderate and wages remain sticky below 3%;

3) The UK and EU fail to agree on the Irish border, leading to a non-negotiated Brexit);

4) Overt UK balance of payments pressure

5) China easing policy and commodities rebound would be a cushion for the Aussie dollar.

Bullish GBPAUD scenarios above 1.8520 levels given:

1) The UK Parliamentary majority in favor of customs union membership frustrates a hard Brexit;

2) Rejection of the withdrawal bill in parliament precipitates fresh election and/or 2nd referendum.

3) The Aussie unemployment rate moves back towards 5.75%, raising risks that the RBA responds to a weakening labor market.

4) China data weaken materially, and risk markets retrace and vol rises.

Potential trigger events: Brexit talks and EU Summit Jun 28-29, BoE (May 10).

OTC updates:

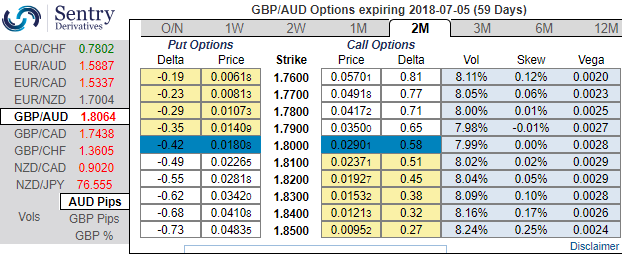

Please be noted that the positively skewed IVs of GBPAUD oof 2m tenors is well-balanced on either side.

Well, all the above-stated macros standpoints are factored in OTC setups that could propel GBPAUD either side but with more downside potential. Accordingly, we advocate below hedging strategy with the cost-effectiveness that could hedge regardless of the swings on either side.

Hedging Framework:

3-Way Options straddle versus Call

Spread ratio: (Long 1: Long 1: Short 1)

The execution: Initiate long in GBPAUD 2M at the money -0.49 delta put, long 2M at the money +0.51 delta call and simultaneously, short theta in 2w (1%) out of the money call with positive theta or closer to zero. Theta is positive; time decay is bad for a buyer, but good for an option writer.

The Vega of a short (sell) option position is negative and an increasing IV is bad. We encourage vega longs and short thetas in the non-directional trending pair but slightly favors bearish strategy as the vega signifies the sensitivity of an option’s value owing to a shift in volatility.

Currency Strength Index: FxWirePro's hourly GBP spot index has turned into 34 (which is mildly bullish), while hourly AUD spot index was at shy above -42 (mildly bearish) while articulating (at 13:15 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary