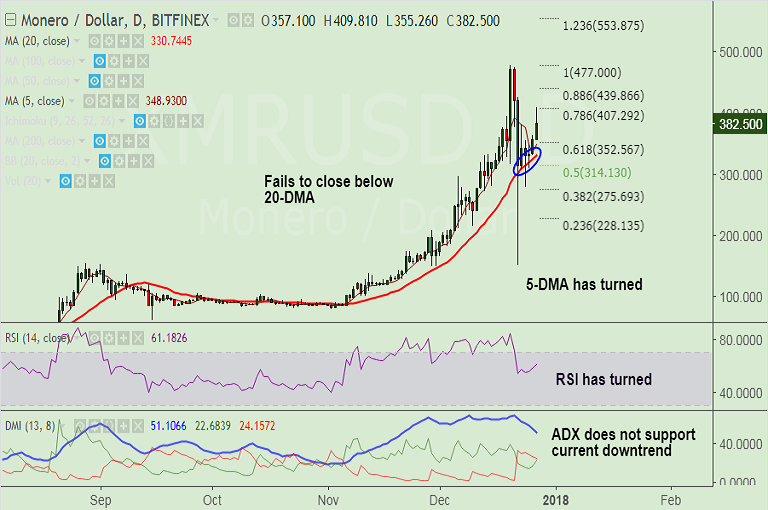

- XMR/USD has found support near 20-DMA currently at 330.73.

- The pair has failed to close below 20-DMA on multiple occasions.

- Technical indicators have turned slightly bullish, we see scope for resumption of upside.

- RSI and 5-DMA have turned higher. ADX has not been supportive of the current downside.

- On intraday charts, the pair has held support at 4H 200-SMA, and has edged above 200-DMA on 1H charts.

- Retest of 477 levels on cards. We see bullish invalidation on close below 20-DMA.

Support levels - 361.71 (1H 200-SMA), 348.89 (5-DMA), 330.73 (20-DMA)

Resistance levels - 407. 29 (78.6% Fib retrace of 477 to 151.26 fall), 439.86 (88.6% Fib), 477 (Dec 20 high)

Recommendation: Good to go long on dips around 370/375, SL: 330, TP: 400/ 440/ 477

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest