Market players will pay close attention to comments from a pair of Fed officials later in the day for further hints on the timing of a U.S. rate hike.

At present the expectation of a Fed hike in June is rising notably. In particular FOMC comments suggesting two or three rate steps before year-end are creating considerable support for the US currency. Well, we reckon a rapid hiking cycle would create much more notable USD strength than an odd rate step here and there.

Gold prices plummeted from the highs of 1303.62 to the current 1229.49, or 5.68%.

Gold for June delivery on the Comex division of the NYME tacked on $4.95, or 0.4%, to trade at $1,228.85 a troy ounce by 07:11GMT.

Fed hikes before 2017 is also very much on cards. The underlying spot gold price is sensitive to moves in U.S. rates, as a rise would lift the opportunity cost of holding non-yielding assets such as bullion.

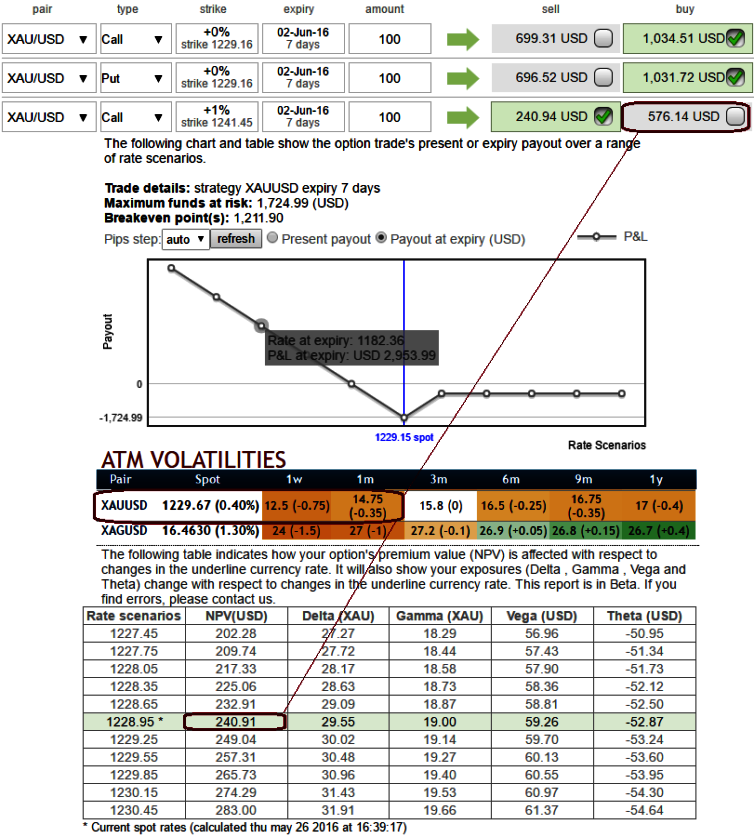

Hedging Framework:

3-Way Options straddle versus Call

Spread ratio: (Long 1: Long 1: Short 1)

Rationale: The current implied volatility of XAU/USD ATM contracts are at 17.85%, and it is likely to shrink to 12.5% for 1W tenors as shown in the IV nutshell.

While, the premiums of 1W ATM calls are trading crazily at 139.96% more than NPV, and 1w (1%) OTM call are trading at 13.96%, hence, contemplating this disparity with risk reversal we think the opportunity lies in writing a OTM call while formulating strategy for gold's uncertainty at this juncture.

Option writers of expensive calls with 1w expiries would be on competitive advantage.

How to execute:

Go long in XAU/USD 1M At the money delta put, Go long 2M at the money delta call and simultaneously, Short 1w (1%) out of the money call with positive theta or closer to zero.

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields