There is no official information yet on the damage and possible victims of the Iranian counter-attack in Iraq, but according to media reports these are considered to be limited. As a result the rocket attack had a swift and painless effect on the markets, and following a reflex-like risk-off reaction they corrected again pretty quickly. That means the market is sticking to its view that the conflict between the US and Iran will not escalate further. Certainly the initial reaction of the Tweeter-in-Chief, Donald Trump, according to which “all is well”, confirms this assumption. Of course market participants are likely to keep an eye on the news flow surrounding the conflict but overall focus is likely to turn to economic data today such as the ADP employment report as a first taste of the official US labour market report at the end of the week.

Amid all these geopolitical tensions and data flow, Japanese Yen remained strong in 2019, outperforming for a second consecutive year. We think the pair’s trading range has narrowed because of a narrowing of the Japan-US inflation differential, a decline in the use of the JPY as a funding currency, and a step up in investment outflows owing to Japanese corporates and investors.

These three factors are unlikely to change significantly in 2020, and we expect USDJPY to move in a narrow core range of 107-112. In the short term, we expect the pair to continue to test the upper end of that range.

Japanese corporates’ foreign direct investment (FDI) outflows reached record highs this year, even as global growth decelerated. Corporates are sitting on more than JPY200 trillion in cash and deposits, and given a lack of domestic investment opportunities, will have no choice but to maintain overseas investment.

Options Trade Recommendations:

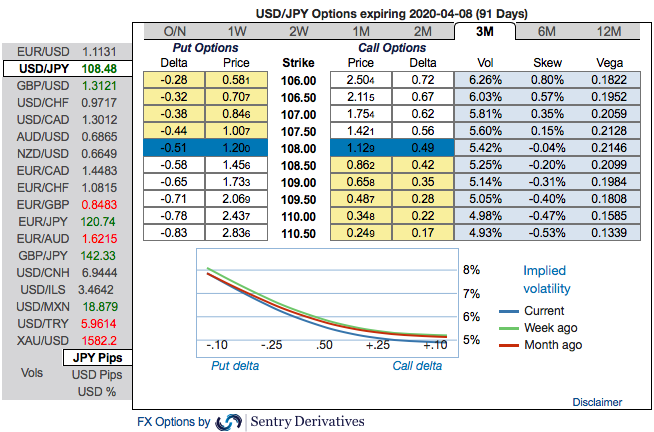

At spot reference of USDJPY: 108.704 levels, we advocate buying a 2M/2w 109.723/107 put spread (vols 5.10 vs 3.76 choice), we would like to maintain the ITM long leg with the diagonal tenors on hedging grounds.

The rationale: The positively skewed IVs of 3m tenors are still signifying the hedging interests for the bearish risks. We see bids for OTM strikes up to 106 levels (refer 1st nutshell).

One can trace out fresh negative risk reversal numbers have been added to USDJPY across all tenors that is substantiating hedging interests for the downside risks (2nd nutshell).

Alternatively, shorting USDJPY futures contracts of mid-month tenors have been advocated, on hedging grounds, we upheld the same positions, as the underlying spot FX likely to target southwards up to 107 levels in the medium run.

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays