- Japanese Yen selling continues unabated, pushing JPY crosses to multi-month highs.

- EUR/JPY hits 120, highest levels since June 24 (Brexit referendum highs).

- USD/JPY hit highs of 113.90, levels unseen since March 15th.

- AUD/JPY is extending a four-day winning streak, trades at 84.30 after hitting highs of 84.62 (highest since Apr 28).

- Sentiment behind the US dollar, which is on fire now, will continue to drive market action.

- Trump victory followed by hawkish FOMC minutes and better-than-expected data keep USD supported.

- Expectations that Fed would be forced to hike rates at a faster pace in 2017 than previously thought is hurting safe -haven gold demand.

- Gold hit fresh 9-month lows of 1170.67, levels last seen since Feb 8th

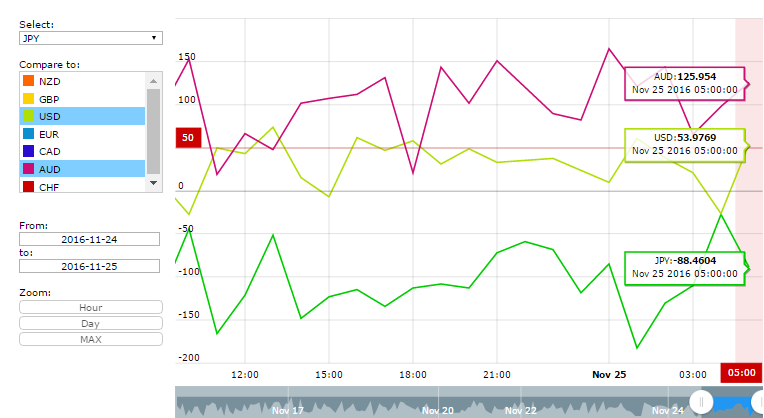

FxWirePro's Hourly Currency Strength Index at 0500 GMT stood as follows:

USD Spot Index: 53.9769 (Neutral)

JPY Spot Index: -88.4604 (Slightly bearish)

AUD Spot Index: 125.954 (Highly bullish)

For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex