The pair is most likely to perceive reducing implied volatility close to 9% of 1M ATM contracts that has reduced from 1W's vols.

Thus, we recommend holding longs on put ladder spreads that contained proportionately less number of shorts and more longs which would take care of potential slumps on this pair and significantly higher volatility times.

So, shorting ITM put with shorter expiry would have fetched desired yields by now as a receipt of initial premiums and holding 2 lots of ATM and OTM put with longer expiry would extract maximum leverage effects in profitability by summing up the returns to above receipt of premiums. Rosy signs for holders since implied volatility is inching lower which is good for option holders.

We could foresee Yen against dollar to gain slightly at least in short run (let's say next 1 months or so) with an anticipation of today's FOMC meet that it may continue to hold on its rate stance until Q1'16 considering global economic slowdown and mixed bag of US markets.

For us, this would mean that market sentiments for dollar have been weaker and this pair is bearish. As a result, we reckon that for next month Yen may pretty much gain out of lots of manipulations and ambiguities are surrounding around dollar.

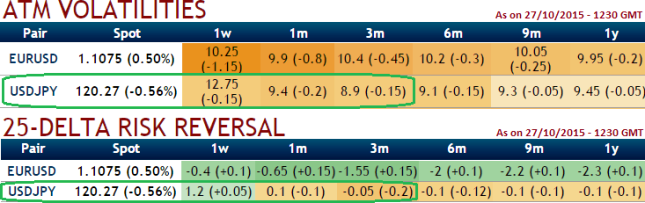

In addition to these speculations, it is also understood that ATM contacts of USDJPY have gradually reduced implied volatilities which is good sign option holders (see and compare current 1w & 1m contracts).

On the other hand, delta risk reversal for the pair is also inching negative values for next 1-2 months, but we believed some short upswings might have been utilized for shorts.

FxWirePro: Yen’s gains on cards ahead of FOMC meet – active longs in put ladder to leverage profitability

Wednesday, October 28, 2015 8:06 AM UTC

Editor's Picks

- Market Data

Most Popular