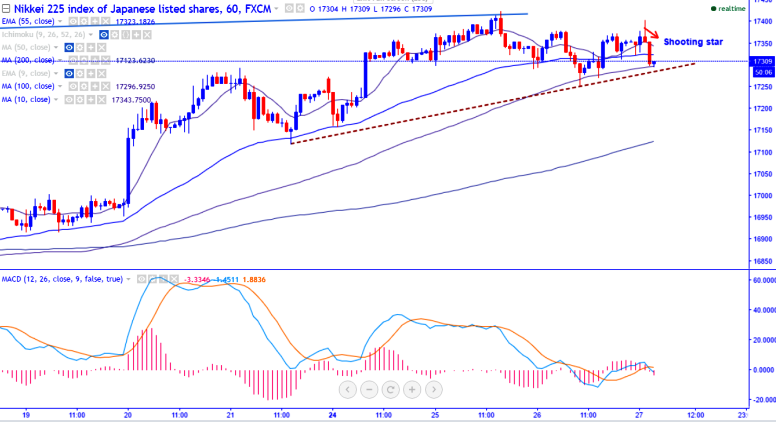

- Major resistance - 17500 (trend line joining 16930 and 17159)

- Major support - 17140 (100- 4H MA)

- Nikkei225 declining continuously for the past two days on US elections uncertainties. The index breaks 100 -4H MA and declined sharply till declined sharply till 16947. Global stock markets and dollar slid for the second day as uncertainties surrounding whether Donald Trump or Hillary Clinton will be next president is dragging the global stock markets for past seven days.

- Technically index is trading slightly below 17000 and it confirms minor weakness, decline till 16860 (daily Kijun-Sen)/16500 is possible.

- On the higher side, resistance is around 17200 and any break above will take the index to next level till 17300/17500.

It is good to sell on rallies around 17150 with SL 17300 for the TP of 16870/16520.