The international focus remains on Fed hike probabilities, with the release of US labour market data on Friday being a potentially critical determinant. Any hawkish comments which could be a detrimental effect on the pairs like AUDUSD.

RBA’s monetary policy is scheduled in 1 week of September; the strong data challenge the RBA’s more benign view of the housing market.

The AUD rebounded from recent lows, but continues to trade sub-0.76 but these rallies could not sustain to drop back at current levels of 0.7555. We could foresee more detrimental effects in this pair by the above fundamental factors going forward.

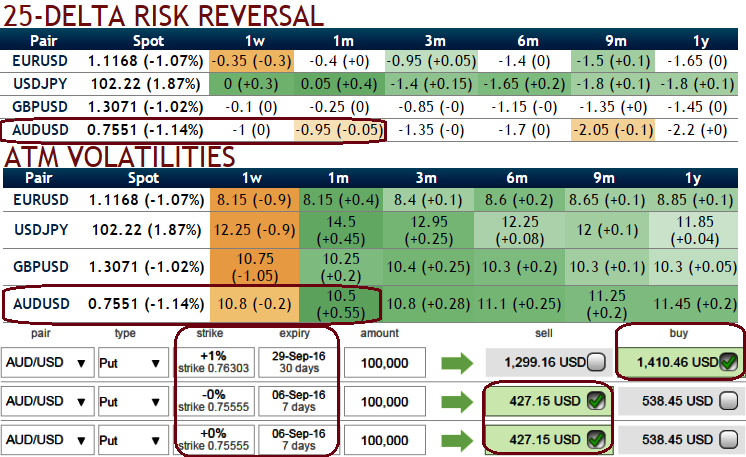

Bidding on 1m risk reversals and 1m implied volatilities we reckon below-advocated option strategy is the most suitable for hedging further downside risks.

At spot ref: 0.7555, execute following options positions so as to construct long put ladder strategy that is likely to hedge puzzling swings on either side.

As shown in the diagram, buy options spread - 2M/1W/1W AUDUSD (strikes 0.7640/0.7555/0.7555).

The long put ladder is the limited returns and unlimited risk strategy as it proportionately employs more shorts in the spread because the underlying FX pair will experience little volatility in the near term (refer IV and sensitivity table).

Ideally, to execute this strategy, the options trader purchases an (1%) in-the-money delta put, short 2 lots of at the money puts the narrowed expiration, however, this’s not hard and fast, one can choose strikes as per his priorities.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX