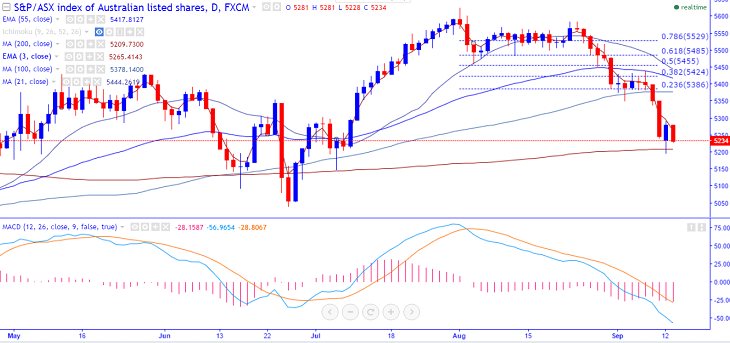

- Major resistance -5296 (3-day EMA).

- Major support - 5208 (200- day MA).

- The index has broken major support at 200- day MA and slightly recovered from that level. It is currently trading around 5231.

- On the higher side,minor resistance is around 5296 (3-day EMA) and any break above 5296 will take the pair till 5382/5400/5429 (55- day EMA)). The index should break above 5625 for further jump till 5700.

- The major support is around 5208 (200- day MA) and any close below targets 5150/5100 in the short term.

It is good to sell on rallies around 5300 with SL around 5351 for the TP of 5205/5155