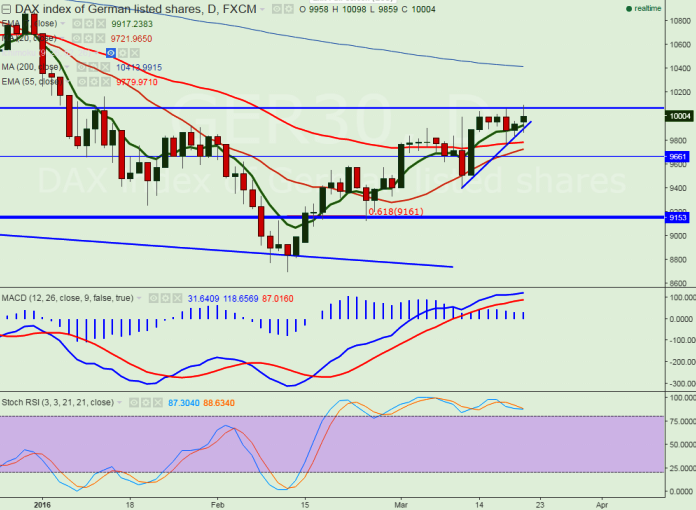

- Major resistance – 10000 (close above 10000)

- Major support -9780 (55 day EMA)

- The index has taken support near 9750 55 day EMA) and jumped till 10098 at the time of writing. It is currently trading around 10003.

- Short term trend is bullish as long as support 9780 holds.

- Any break below 9780 will drag the index down till 9720/9640.

- On the higher side any close above 10000 will take the index to next level till 10165/10400.

- Short term bullish invalidation only below 9300.

It is good to buy at dips around 9950 with SL around 9780 for the TP of 10400