• EUR/NZD declined on Wednesday as New Zealand dollar advanced against euro after on strong employment data.

•In the second quarter, New Zealand saw a 0.4% increase in job growth, a rebound from the -0.2% decline in Q1 and better than the anticipated -0.2%. The unemployment rate rose from 4.4% to 4.6%.

• Rising unemployment and the lowest annual wage growth in two years in New Zealand suggest that the central bank may cut interest rates by year-end.

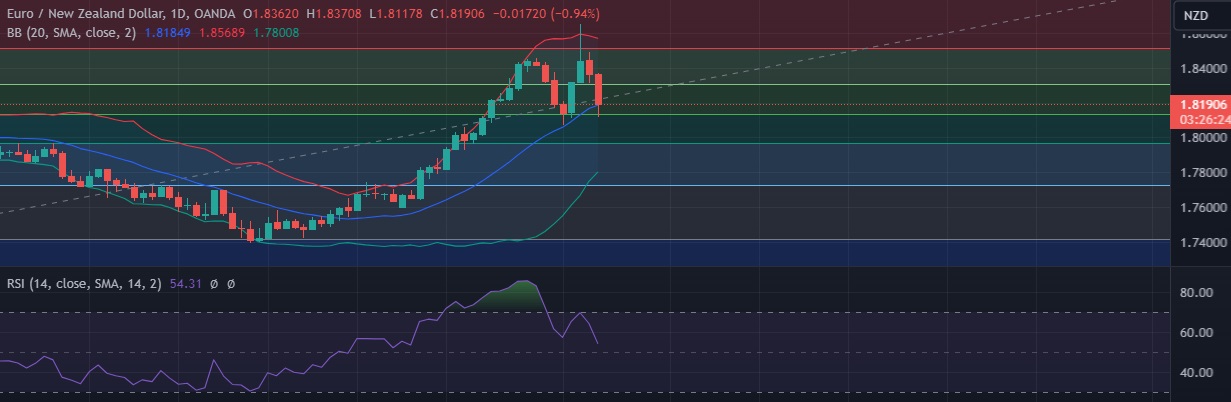

• Technical signals show the pair could lose more ground as RSI has turned sharply lower, and 5, 9 DMA’s are trending south.

• Immediate resistance is located at 1.8300 (38.2%fib), any close above will push the pair towards 1.8452(July 26th high).

• Immediate support is seen at 1.8136 (50% fib) and break below could take the pair towards 1.7966(61.8% fib).

Recommendation: Good to sell around 1.8200, with stop loss of 1.8300 and target price of 1.8130