• GBP/ AUD rose on Friday as rising expectations for the Bank of England to raise interest rates earlier than expected lifted the pair.

• The British pound held firm against weaker Australian dollar on Friday after a Bank of England policymaker said on on Thursday said that,BOE was likely to interest rates next year.

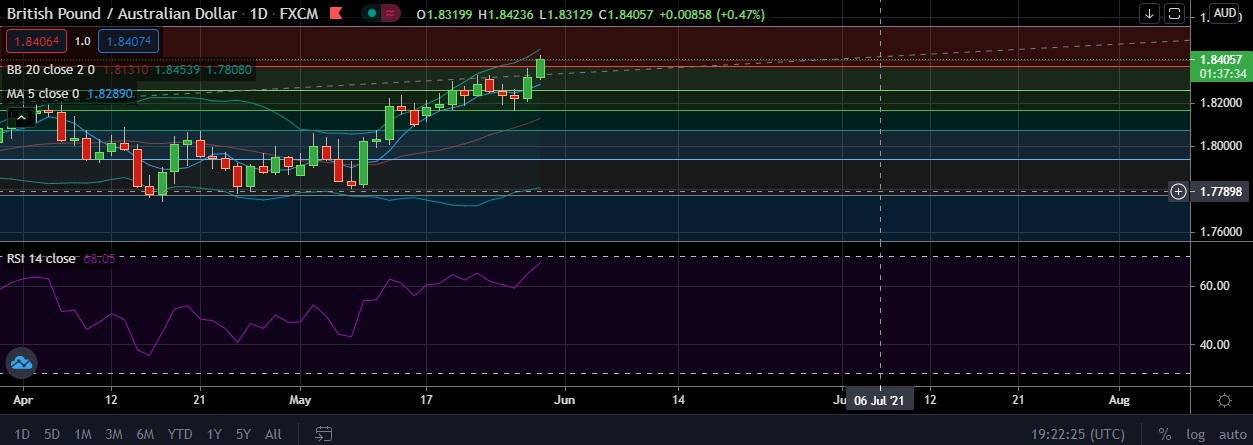

• Technical signals are strongly bullish as RSI is at 67, daily moving averages are trending up.

• Immediate resistance is located at 1.8440 (Higher BB), any close above will push the pair towards 1.8500(Psychological level).

• Immediate support is seen at 1.8370 (5DMA) and break below could take the pair towards 1.8286 (5DMA).

Recommendation: Good buy around 1.8350, with stop loss of 1.8240 and target price of 1.8500