• GBP/ NZD initially dipped on Wednesday but recovered most of the ground as improving risk appetite boosted pound .

• The pound was supported by improving risk appetite as global stock markets bounced back after falling on Tuesday on the back of concerns over the new coronavirus variant Omicron.

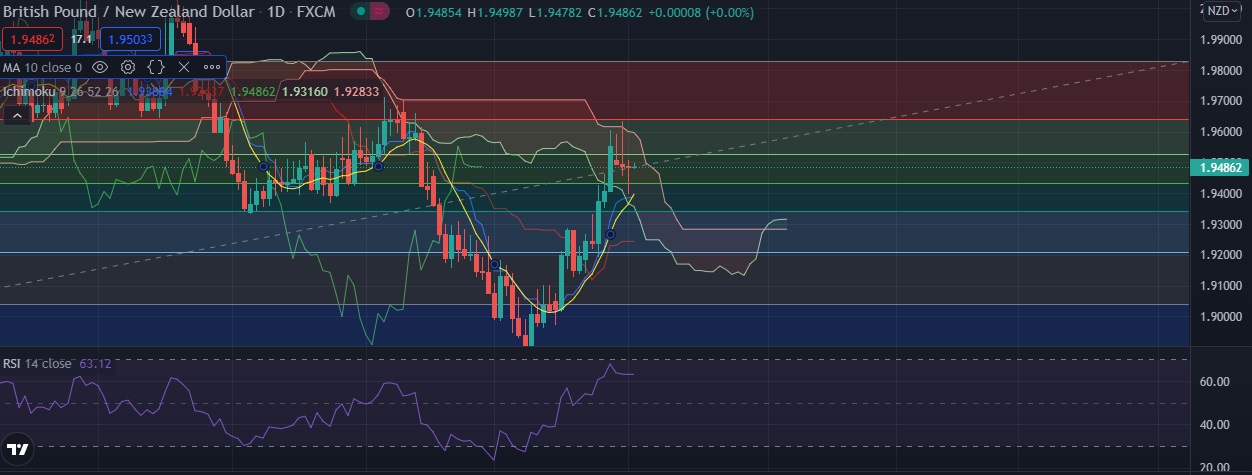

• Technical signals show the pair could gain more ground in the short-term as RSI is at 63 bullish, daily momentum studies 9, 11,14 DMAs are trending up.

• Immediate resistance is located at 1.9530 (38.2% fib), any close above will push the pair towards 1.9600 (Ichimoku Cloud Top).

• Immediate support is seen at 1.9430 (50% fib) and break below could take the pair towards 1.9400 (10 DMA).

Recommendation: Good to buy around 1.9480, with stop loss of 1.9380 and target price of 1.9550