• GBP/ NZD strengthened on Tuesday as traders lighten long positions ahead of Wednesday's UK CPI release and Thursday's Bank of England rate announcement.

• Wednesday's UK price data is forecast to dip to 8.4% year-over-year from 8.7% in April..

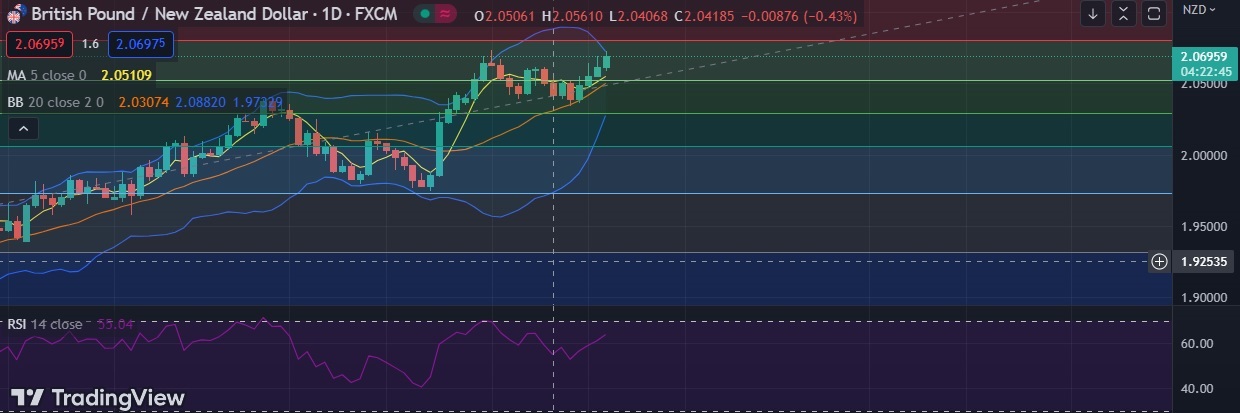

• A close above 2.0726 should trigger a new bullish phase with potential for 2.0800

• Technical signals show the pair could gain more ground in the short-term as RSI is at 64,while moving averages and MACD are trending higher.

• Immediate resistance is located at 2.0726 ( Higher BB), any close above will push the pair towards 2.0804(23.6%fib).

• Immediate support is seen at 2.0596 (Daily low) and break below could take the pair towards 1.20527 (38.2%fib).

Recommendation: Good to buy around 2.0680, with stop loss of 2.0600 and target price of 2.0740