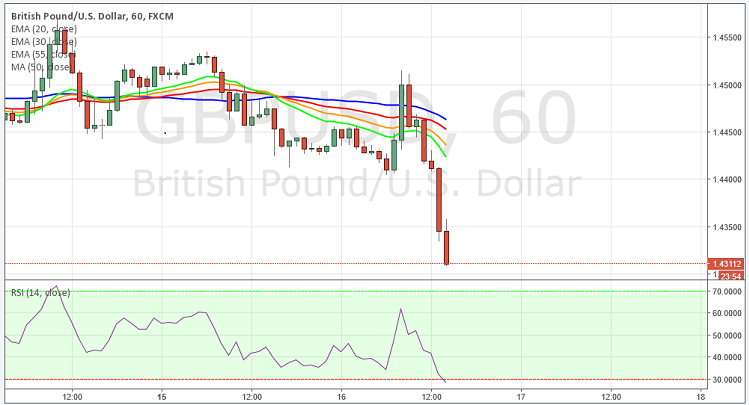

GBP/USD declined sharply on Tuesday as the greenback rose against sterling following soft UK inflation data. The GBP/USD pair made some healthy gains in early European session hitting as high as 1.4515 but the pair was weighted down by soft data and decline in European stocks.

- Currently the pair is trading around 1.4422 levels , it is set to decline further towards 1.4200 and later 1.4150 level.

- Technically in the 4 hour chart the 55, 30 and 20 MA depicts a clear bearish slope above the current price action, the RSI is indicating towards downside at 29.

- To the upside, the strong resistance can be seen at 1.4447, a break above this level would expose the cable to next resistance level at 1.4465 levels.

- To the downside strong support can be seen at 1.4309, a break below at this level will open the door towards next level at 1.4221.

Recommendation: Go short around 1.4340, targets 1.4260, 1.4180, SL 1.4470

Resistance Levels

R1: 1.4380 (50% Retracement level)

R2: 1.4447 (61.8 % Retracement level)

R3: 1.4465 (21 DMA)

Support Levels

S1: 1.4309 (38.2 % Retracement level)

S2: 1.4221 (23.6 % Retracement level)

S3: 1.4146 (Jan 29th lows)