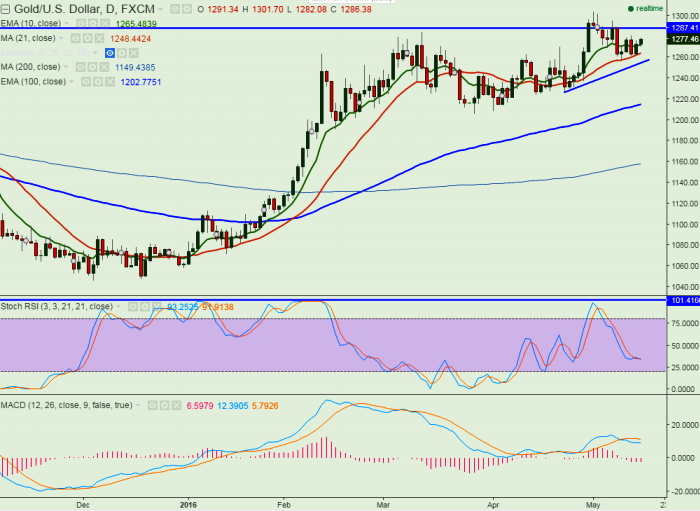

- Major support - $1261 (21 day MA)

- The yellow metal has once again taken support near $1260 and recovered from that level. It is currently trading around $1277.

- Short term trend is slightly bullish as long as support $1260 holds.

- Any breach below $1260 will drag the commodity down till $1242/$1228 in short term.

- On the higher side resistance is around $1279.20 (Tenken-Sen) and break above targets $1285/$1300/$1304.

- Gold should break above temporary top $1303 for further bullishness.

It is good to buy at dips around $1270 with SL around $1260 for the TP of $1285/$1300