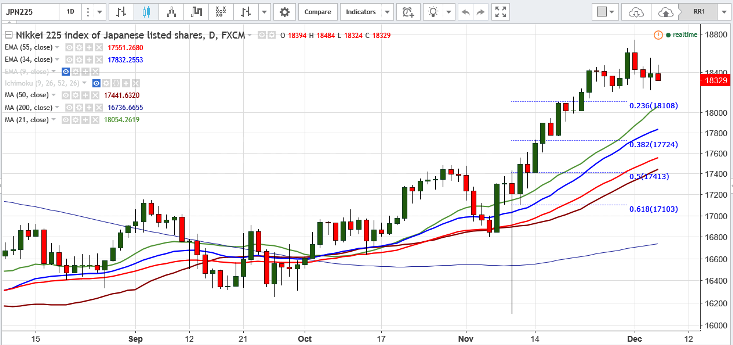

Nikkei225 has slightly recovered after making a low of 18224 .The index declined from the high of 18742 after PM resigns on a clear referendum defeat. It is currently trading at 18344 0.26% lower.

•Technically index is slightly bullish as long as support 18200 holds.

•On the higher side, major resistance is around 18800 and any break above targets 19000/19300 in the short term.

•The index immediate support is at 18200 and any break below targets 18000 (21- day MA)/ 17800 (34- day EMA).

•The index should break below 16800 for further weakness.

It is good to buy on dips around 18200 for the TP of 18000 for the TP of 18750/19000.