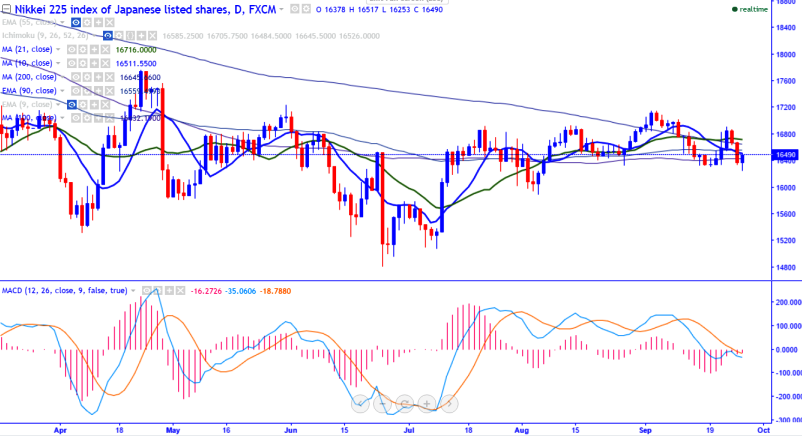

- Nikkei225 has recovered sharply till 16510 from the low of 16253 made at the time of writing.It is currently trading around 16495.

- Short term trend is slightly bullish as long as resistance 17000 holds.

- Technically in the daily chart the index is trading well below Kijun-Sen (16735) and well above Tenken-Sen (16615).It should break above 10- day MA for slight bullishness.

- On the higher side, resistance is around 16525 (10- day MA) and any break above targets 16616 (daily Tenken-Sen)/16737 (daily Kijun-Sen)/ 17000/17159.Nikkei should break above 17159 for further bullishness.

- The major support is around 16250 (38.2% retracement of 14823 and 17159) and any break below targets 16000.

It is good to buy on dips around 16400 with SL 16250 for the TP of 16730/16800