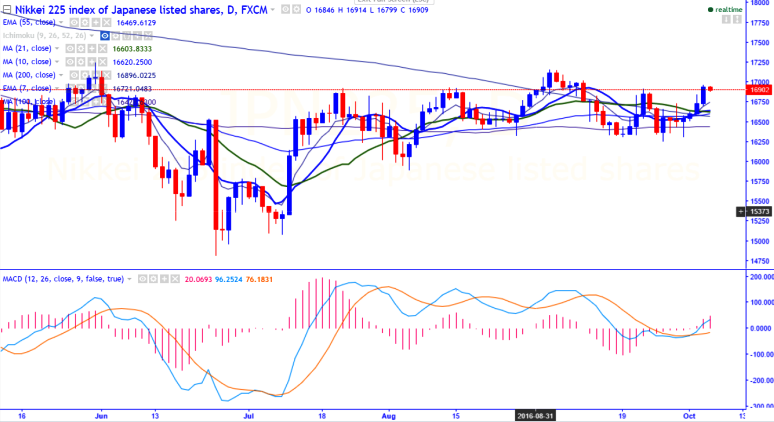

- Nikkei225 is trading 0.30% in the Asian session after jumping sharply yesterday. Japanese index has once gain declined after making a high of 16967 yesterday . It is currently trading around 16892.

- The index has broken the high made on Sep 22nd at 16918 and jumped slightly from that level.

- Technically in the daily chart the index is trading above Kijun-Sen.Any close above Kijun-Sen confirms minor bullishness.But it should break above psychological .at 17000.

- On the higher side, resistance is around 17000 and any break above targets 17159.Nikkei should break above 17159 for further bullishness.

- The major support is around 16705 (daily Kijun-Sen)and any break below targets 16605 (daily Tenken-Sen)/16438 (100- day MA).

It is good to sell on rallies around 16900-950 with SL 17160 for the TP of 16610/16450