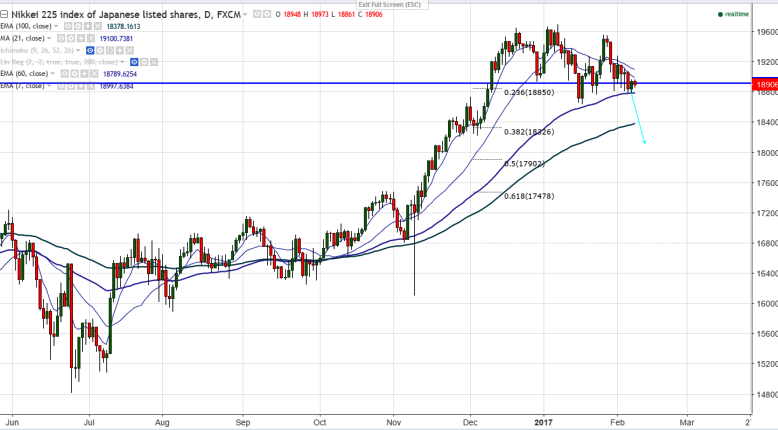

- Nikkei is trading in narrow range between 19285 and 17796 for the past five trading session. The index is facing strong support at 60- day EMA and any break below confirms further weakness.

- The index is trading weak on account of stronger yen and the pair has taken support near 100 -day EMA and slightly jumped from that level.It is expected to decline till 110.45 in the short term.

- On the lower side , 18785 is acting as next immediate support and any break below targets 18638 (Jan 18th 2017 low)/18367 (100- day EMA).

- The major weekly resistance is around 19030 (7- EMA) and any break above will take the index till 19140 (10- day MA)/19285 (Feb 1st high).

It is good to sell on rallies around 19000-19025 with SL around 19300 for the TP of 18450/18100.