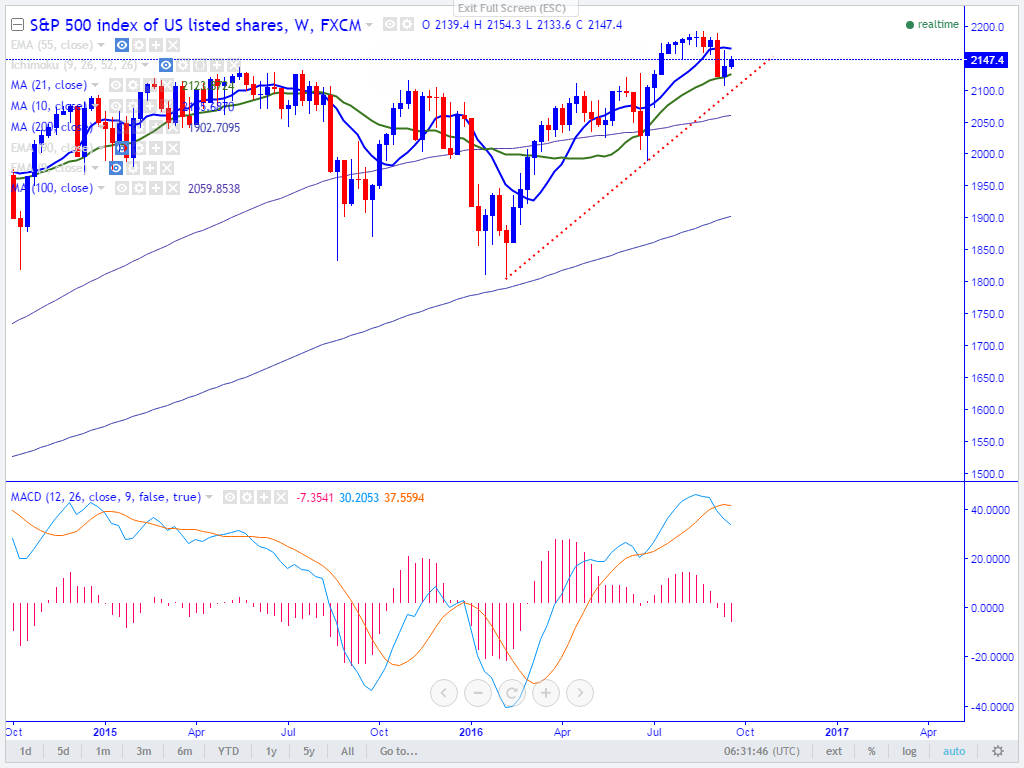

- Major support – 2090 (trend line joining 1807 and 1989, weekly Kijun-Sen).

- Major resistance – 2166.80 (10- day MA).

- The index pared its previous week loss and jumped till 2154 at the time of writing. It is currently trading around 2147.90.

- Major trend reversal of the index can happen only above 2166 (10- day MA) and break above that level will take the index to next immediate resistance at 2193.9 (Aug 15th 2016 high)/2246 (161.8% retracement of 2193.40 and 2108) in the short term.

- On the lower side, any break below 2090 will drag the index down till 2060 (100- W MA)/2046 (38.2% retracement of 1807 and 2193.90).

It is good to buy on dips around 2125 with SL around 2090 for the TP of 2194