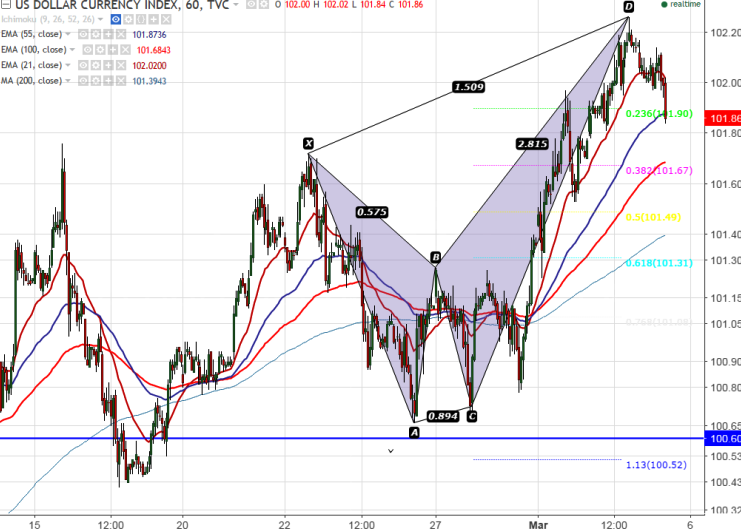

- Harmonic pattern formed – Bearish Cypher pattern

- Potential Reversal Zone (PRZ)- 102.26

- Major intraday support –100.60

- U.S. Dollar index has jumped till 102.26 after breaking minor resistance 102.06.It is currently trading around 101.93.

- On the higher side, major resistance is around 102.30 and any break above will take the index till 102.95 (Jan 1st 2017 high).

- The major intraday support is around 101.38 (200- H MA) and any break below targets 100.60/100/99.25 (23.6% fibo).

- Short term bullish invalidation only below 98.

It is good to sell on rallies around 101.95-102 with SL around 102.26 for the TP of 101.35/100.80