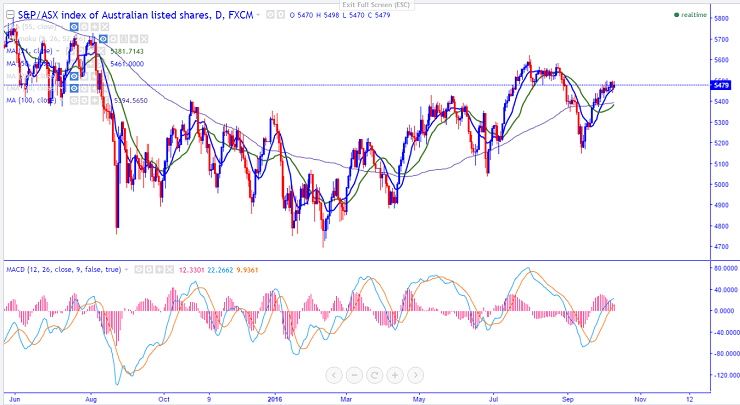

- Major support -5440 (10- day MA).

- The index has formed a double top around 5502 and started to decline from the higher level.It is currently trading around 5476.

- ASX200 is trading well above Tenken-Sen (5437) and Kijun-Sen (5327) in the daily chart.But it should break above 5502 for further bullishness.

- On the higher side,the index is facing psychological resistance at 5505 and any break above 5500 confirms minor bullishness, a jump till 5625 is possible. The index should break above 5625 for further jump till 5700.

- The minor support is around 5445 (10- day MA) and any break below targets 5390 (100- day MA)/5360 (21- day MA) in the short term.

It is good to sell on rallies around 5495-5500 with SL around 5550 for the TP of 5445/5390.