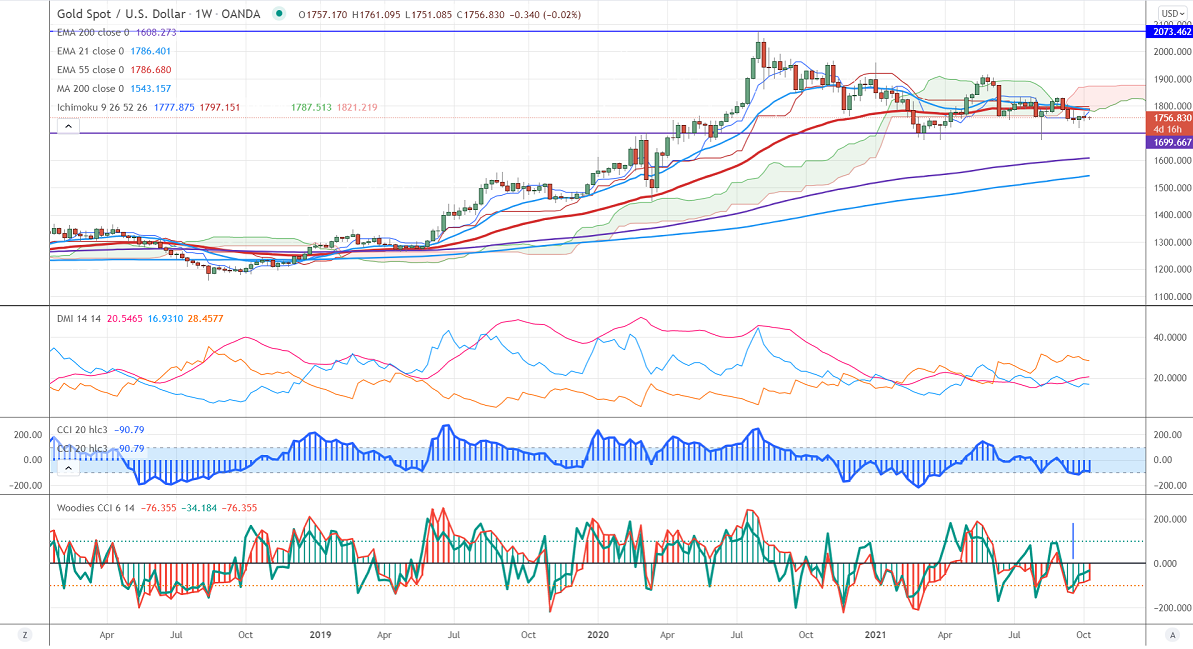

FxWirepro: Gold Weekly outlook

Ichimoku analysis (Weekly chart)

Tenken-Sen- $1755

Kijun-Sen- $1795

Gold pared most of its gains made after US jobs data. The US economy has added 194000 jobs in Sep vs forecast of 490K. While the unemployment rate declined to 4.8% from a forecast of 5.1%. The US dollar index is trading in a narrow range between 94.44 and 93.67 for the past week. Any surge past 94.50 confirms further bullishness. The number of people who have filed for jobless benefits declined last week by 38000 to 326000 compared to a forecast of 350000. Gold hits an intraday high of $1761.05 and is currently trading around $1756.32.

Factors to watch for gold price action-

Global stock market- Slightly bullish (negative for gold)

US dollar index – Bullish (negative for gold)

US10-year bond yield- bullish (bearish for gold)

Technical:

It is facing strong support at $1740 violation below targets $1720/$1700. Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1787, any convincing break above will take the yellow metal $1800/$1825/$1835/$1860/$1900 is possible.

It is good to sell on rallies around $1785-86 with SL around $1800 for TP of $1720.