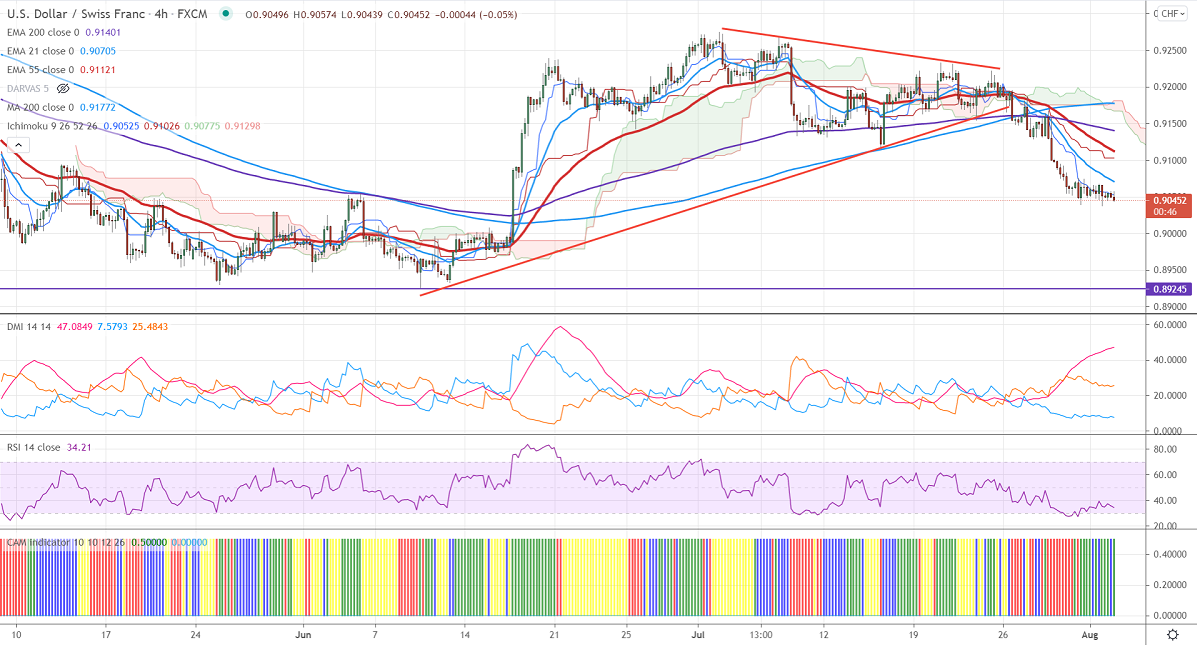

Ichimoku analysis (4-hour chart)

Tenken-Sen- 0.90525

Kijun-Sen- 0.91026

Previous week low– 0.90391

The pair is trading weak and holding well below 200-day MA. The surge in coronavirus across various continues has increased demand for safe-haven assets. The US ISM for July came at 59.50 below the estimate of 60.4. The US 10-year yield slipped below 1.15%, the lowest level since Feb 2021.USDCHF hits an intraday low of 0.9440 and currently trading around 0.90465.

.

Trend- Bearish

The near-term support is around 0.90300, any breach below confirms further weakness. A dip till 0.9000/0.8925. On the higher side, immediate resistance is around 0.9075 (200-day MA). Any convincing breach above targets 0.91150 (support turned into resistance)/ 0.9128/0.9150/0.9185.

.

Indicator (4 Hour chart)

CAM indicator – Bearish

Directional movement index –Bearish

It is good to sell on rallies around 0.9075 with SL around 0.9120 for a TP of 0.8925.