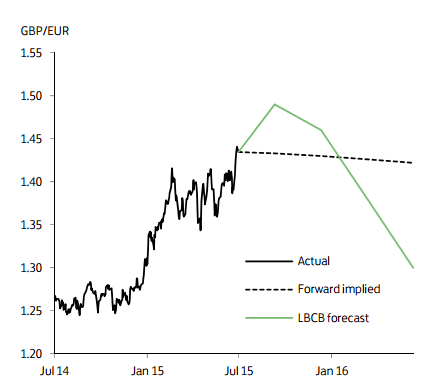

GBP/EUR has recently hit an 8-year high above 1.44. The combination of more hawkish UK monetary policy comments and ongoing uncertainty about Greece's prospects has fuelled the rally. The break higher opens the way for a move up towards 1.50 over the coming months, given the diverging policy outlooks in the UK and the euro area and the likelihood that Greek uncertainty continues to impact euro sentiment.

Further out, however, the prospects of a sustained rise in GBP/EUR are, limited. Assuming there is some resolution to the Greek crisis (supported by an eventual agreement on debt relief), the focus is likely to turn to the relative undervaluation of the euro - particularly if, euro area growth continues to post a steady recovery. Brexit uncertainty, fiscal austerity, and the UK's substantial external deficit with the euro area are also likely to weigh on the pound over the medium term.

"We have revised up our Q3 call to 1.49 but look for a steady move lower thereafter," said Lloyds Bank in a report on Monday.

GBP/EUR Outlook

Monday, July 20, 2015 8:55 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed