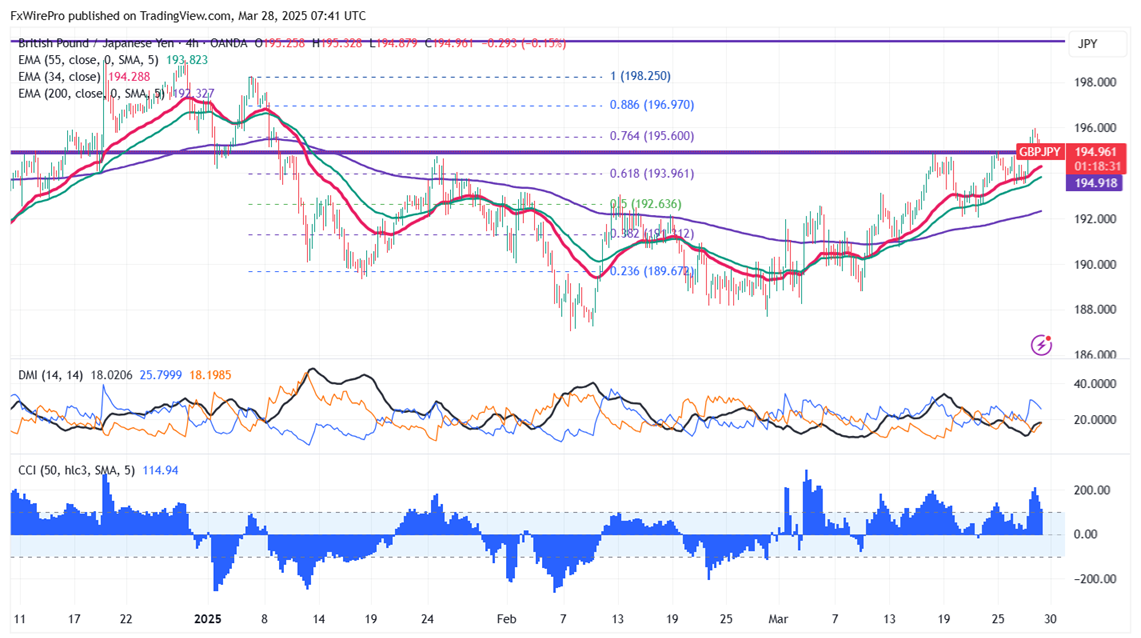

The GBP/JPY pared some of its gains despite strong UK retail sales data. It hits an high of 195.98 yesterday and is currently trading around 195.05. Intraday trend is bullish as long as support 193 holds.

Retail Sales Surprise:

UK high-street sales surprisingly advanced by 1.0% month-to-month in February 2025, contrary to the market's prediction of a decline of 0.3%, on the strength of food shop sales growth, but non-food sales like clothing and home furnishings fell. Retail sales rose 1.0% from last year's level, lagging last month's 2.8% increase. Such good news is welcomed by retailers during times of consumer optimism and anticipation of further drops and may have bullish impacts on market sentiment in the short term

Technical Analysis Points to Further Upside

The GBP/JPY pair is trading above 34 and 55 EMA (Short-term) and 200 EMA (long-term on the 4-hour chart, confirming a bullish trend. Immediate resistance is at 196, a breach above this level targets of 196.97/198. Downside support is at 194.75 with additional levels at 193.85/193.45/193//192.45/191.70/191/189.80/188.75/188/187.25/186/185.

Market Indicators

CCI (50)- Bullish

Directional movement index - Neutral

It Is good to buy on dips around 194.75-80 with a stop-loss at 193.85 for a TP of 197