Once again falling after a slight jump above the 200 mark, GBP/JPY. The pair displayed a strong gap-up opening as Japan's political instability caused the yen to depreciate. Trading now at 199.51, it hit an intraday high of 200.34. Intraday trend is neutral as long as the resistance at 200.35 holds.

On September 7, 2025, following two significant electoral losses that caused his party to lose a coalition majority, Japanese Prime Minister Shigeru Ishiba resigned, setting off political turmoil and a quick yen depreciation. As markets fought with doubts about Japan's political transformation, the yen plummeted dramatically versus important currencies like USD, EUR, and GBP to multi-year lows. Market volatility has increased as a result of worries about policy direction, possible leadership supporting more lax fiscal and monetary positions, and consequences for the Bank of Japan's future choices. Analysts forecast ongoing yen weakness in the face of the leadership void, spurred by Japan's large interest rate difference with major economies, while Japanese equities and bonds face mixed reactions on potential fiscal stimulus under a new administration.

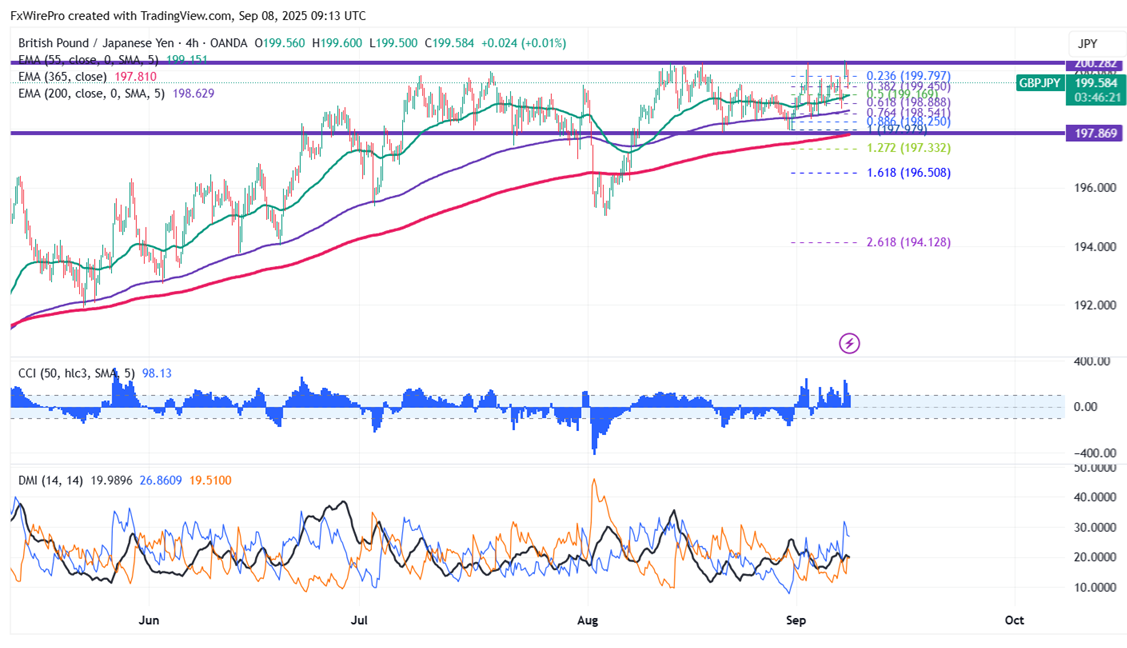

The pair is trading above 55 and 200 EMA and 365 EMA (long-term) on the 1-hour chart, confirming a bullish trend. Any violation below 199.40 indicates the intraday trend is weak. A dip to 198.75 198/197.85/197.25/ 196.70/196.20/195 is possible. Immediate resistance is at 2000, a breach above this level targets 200.35/202.

Market Indicators ( 4-hour chart)

CCI (50)- Bullish

Directional movement index - Neutral

Trading Strategy: Buy

It is good to buy on dips around 199.28-30 with SL around 198.60 for a TP of 202.