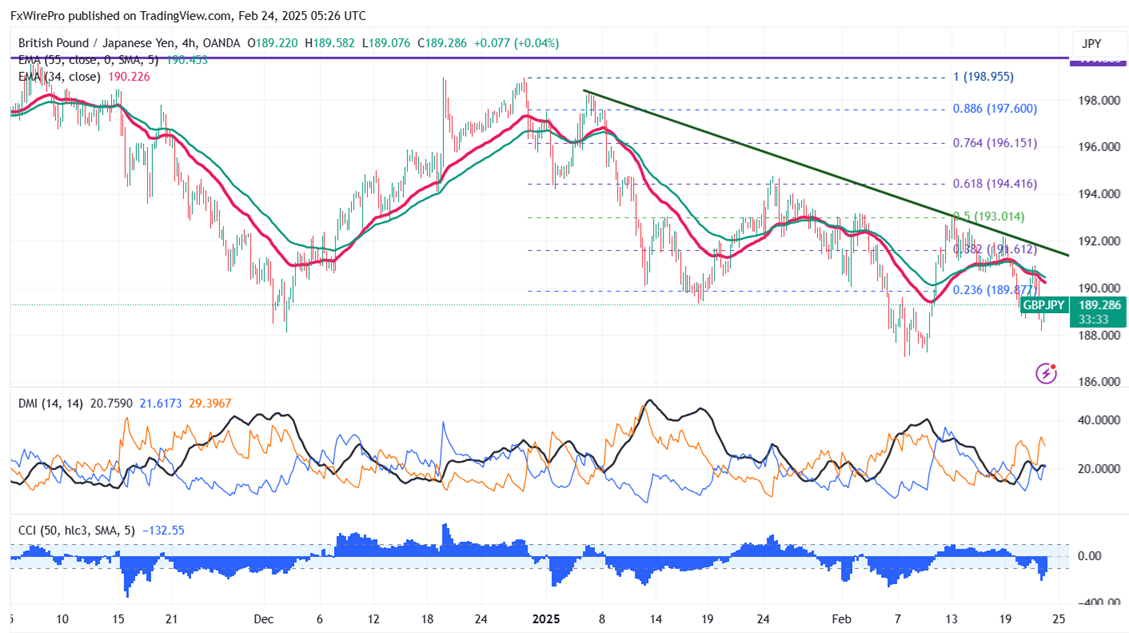

The GBP/JPY trades weak on the strong yen. It hit an intraday low of 188.15 and is currently trading around 189.308. Intraday trend is bearish as long as resistance support 190 holds.

JGB Yields Soar: A Testament to Japan's Economic Might

The 10-year Japanese Government Bond (JGB) yield has risen by approximately 35 basis points year-to-date, reaching around 1.44% as of mid-February 2025 15. This increase is attributed to Japan's robust economic growth, with a GDP increase of 2.8% in Q4 2024, and market anticipation of further interest rate hikes by the Bank of Japan (BoJ). The rising yields mirror a shift towards a more hawkish monetary policy and growing inflation concerns amid stronger economic activity and potential price pressures 1. Reaching levels not seen in over 15 years, the 10-year JGB yield underscores significant economic and monetary policy adjustments in Japan

Technical Outlook: GBP/JPY Navigates Bearish Territory

The GBP/JPY pair is trading below 34 and 55 EMA (Short-term) and 200 EMA (long-term) on the 4-hour chart, confirming a bearish trend. Immediate resistance is at 190; a breach above this level targets 190.64/191/192. Any close above 192 in the 4-hour chart confirms further bullishness. Downside support is at 188.70 with additional levels at 188/187.25/185.

Market Indicators

CCI (50)- Bearish

Directional movement index - Bearish

It is recommended to sell on rallies around 190 with a stop-loss at 191 for a TP of 188.