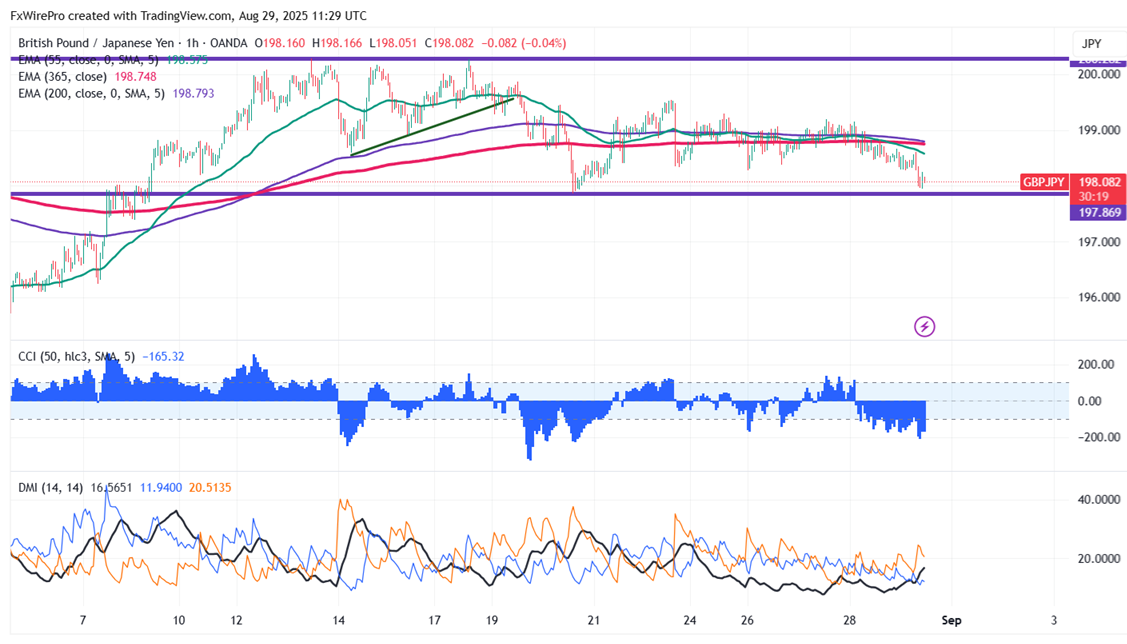

The GBP/JPY trades in a narrow range with a neutral bias. It hit an intraday low of 197.94 and is currently trading around 198.11. The intraday trend remains bearish as long as the resistance at 200 holds.

The pair is trading below the 55 and 200 EMA, as well as the 365 EMA (long-term), on the 1-hour chart, confirming a mixed trend. Any violation below 197.85 indicates the intraday trend is weak. A dip to 197.25/ 196.70/196.20/195 is possible. Immediate resistance is at 198.55 a breach above this level targets of 199/199.55/200/200.28/202.

Market Indicators ( 1-hour chart)

CCI (50)- Bearish

Directional movement index - Bearish

Trading Strategy: sell

It is good to sell on rallies around 198.78-80 with SL around 200 for a TP of 195