GBP/JPY jumped sharply on weak yen. It hits an high of 191.72 yesterday and is currently trading around 190.967. Intraday trend is bullish as long as support 190 holds.

UK retail sales volumes increased in March 2025 by 0.4% from the previous month, the third successive monthly rise, with growth in the quarter of 1.6%, the strongest since July 2021. Sales year-on-year were 2.6% higher as a result of a 3.7% increase in sales of clothing and footwear as a consequence of unseasonably mild weather, and a 1.7% increase in non-food stores. Sales in food stores fell by 1.3%. While the economy started 2025 on a high, economists are also cautious as consumer confidence fell in April following record energy bills for families and trade tensions and as big retailers such as Tesco and Sainsbury's predicted subdued profit growth. Retailing added 0.08 percentage points to economic output, and issues of longevity around it in the context of external economic pressures.

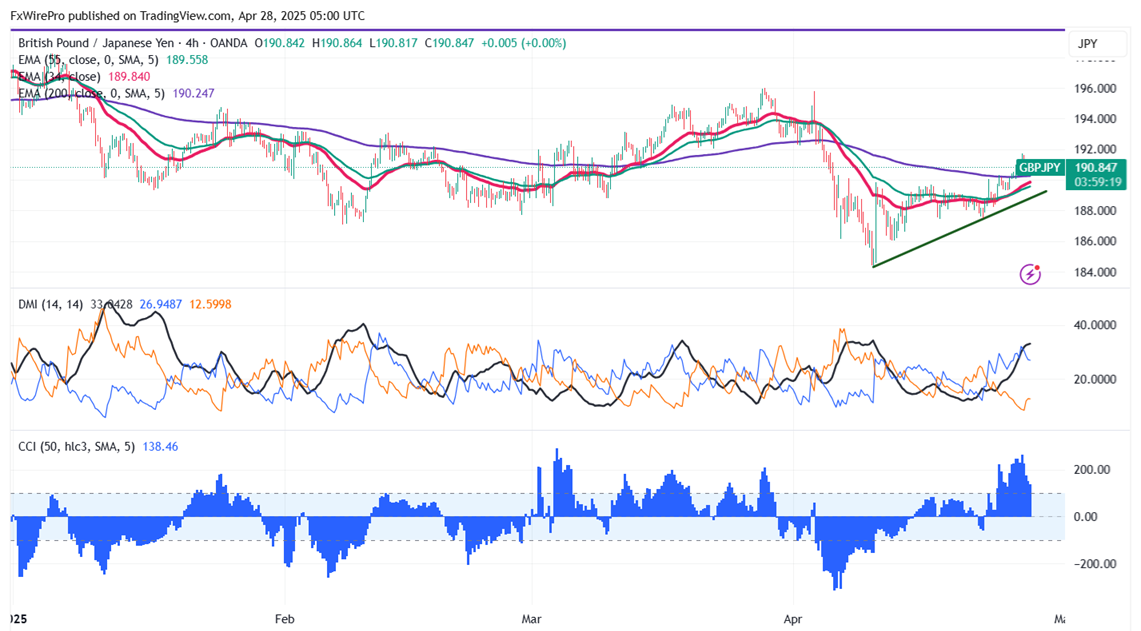

The GBP/JPY pair is trading above 34 and 55 EMA (Short-term) and below 200 EMA (long term on the 4-hour chart, confirms a mixed trend. Immediate resistance is at 190.30,a breach above this level targets of 191/191.75/192.30/193. Downside support is at 190 with additional levels a 189.46/188/187.46/187.10/186.45.

Market Indicators

CCI (50)- Bullish

Directional movement index - Bullish

Trading Strategy: Buy on dips

It Is good to buy on dips around 190 with SL around 189 for a TP of 192.