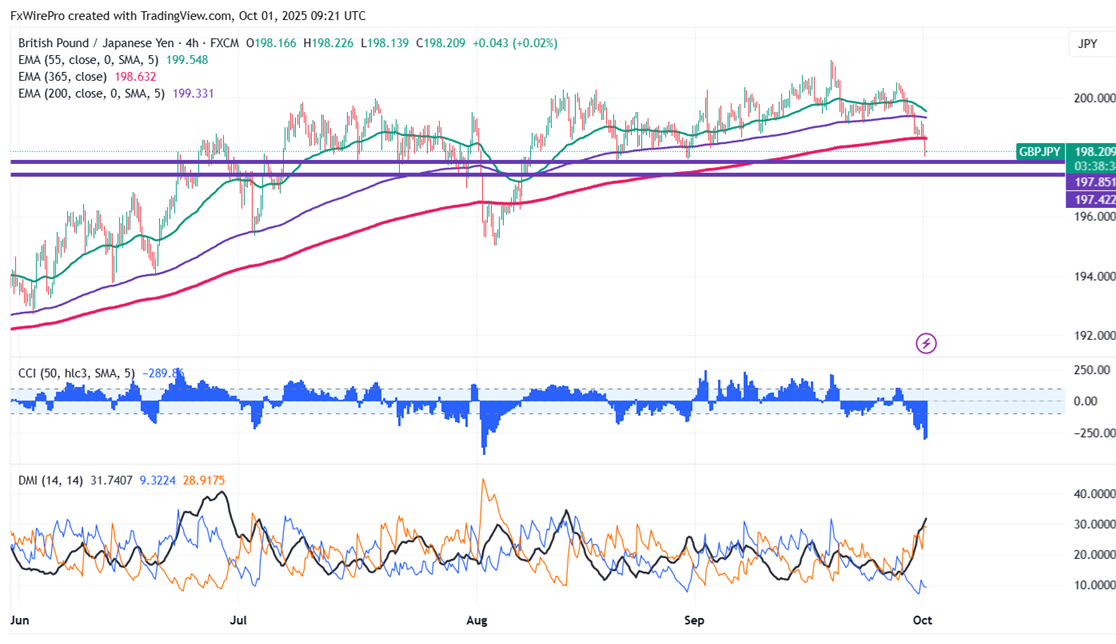

GBPJPY pared most of its gains on the strong yen. Presently trading around 198.19, the pair hit an intraday low of 198.01.

Oscillators and moving averages to forecast the trend of NDJPY

CMP- 198.15

EMA (4-hour chart)

55-EMA- 199.59

200-EMA- 199.34

365-EMA- 198.63. The pair trades below the short-term moving average and above the long-term moving average.

Previous week low- 199.11 (Sep 22nd low). The pair holds well below that level. Any breach below 198 will drag the pair down to 197.75/197.43/196.95.

Previous week high- 200.51 (Sep 25th high). Any break above 198.60 confirms minor bullishness; a jump to 199.20/199.60/2000 is possible.

Indicator (4-hour chart)

CCI (50)- Bearish

Average directional movement Index- Bearish. All indicators confirm a bearish trend.

It is good to sell on rallies around 198.48-50 with SL around 199 for TP of 197.