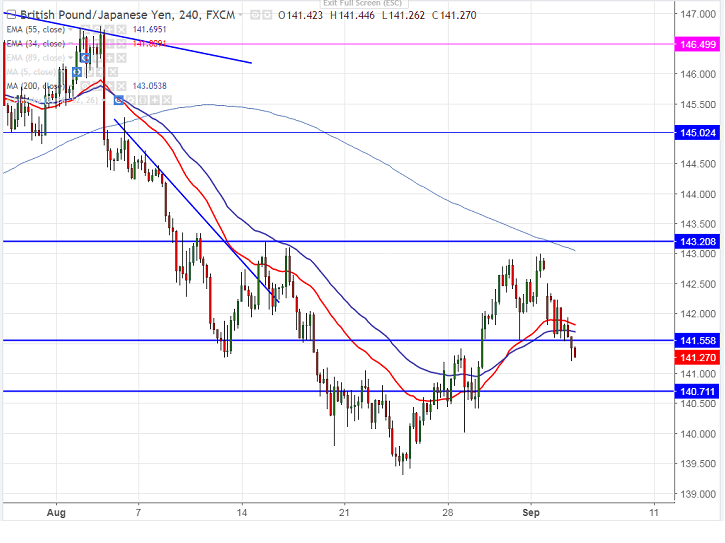

- GBP/JPY declined sharply and has broken major support 141.55 low made on Aug 31st 2017 after hitting high of 142.99 and any further bullishness can be seen only above 143.20. The JPY trades higher against all major pair after renewed tensions in North Korea. It is currently trading around 141.75.

- The pair declined till 141.19 from the minor top of 142.99. The decline from 147.77 will come to a n end at 139.30 if the pair breaks above 143.20 level.

- On the lower side, major support is around 141.40. Any break below 141.40 will drag the pair till 141 (200- H MA)/140. Minor bearish continuation only below 139.30 level.

- The near term resistance is around 142.65 (34- day EMA) and any break above will take the pair till 143.20/144.

It is good to sell on rallies around 141.85-90 with SL around 143.20 for the TP of 139.40.

Resistance

R1- 142.25

R2 143.20

R3- 144

Support

S1-141

S2-140

S3-139.30