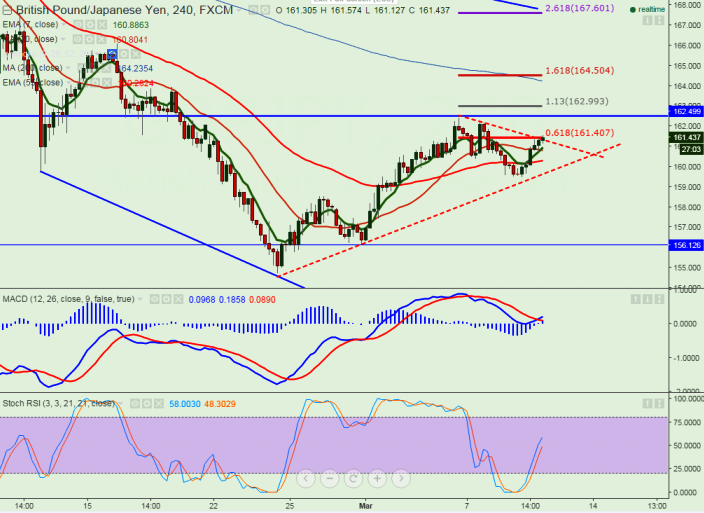

- Major Resistance - 161.40 (trend line joining 162.43 and 162.22)

- Major Support - 160.70

- The pair has broken major resistance 161.40 and jumped till 161.57. It is currently trading around 161.45.

- Short term trend is slightly bullish as long as support 160.70 holds.

- On the higher side break above 161.40 will drag the pair till 162.50/163/164.50.

- Intraday weakness can be seen only below 160.70 and break below targets 160.30/159.50.

- Short term bullish invalidation below 159.20.

It is good to buy at dips around 161.30-35 with SL around 160.70 for the TP of 162.50/163.90