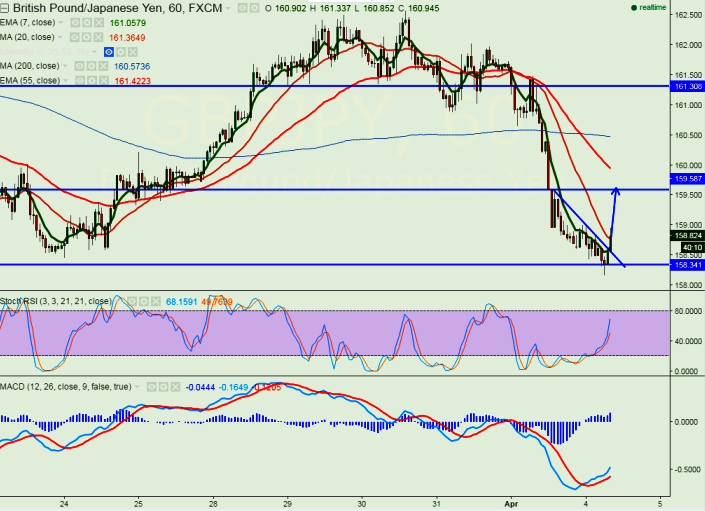

- Minor resistance 158.60 (trend line joining 159.56 and 158.83)

- Major support -158

- The pair has recovered after making a low of 158.16 at the time of writing. It is currently trading around 158.83.

- Intraday trend is slightly bullish as long as support 158 holds.

- Any break below 158 will drag the pair down till 156.50/156 in short term.

- On the higher side any break above 158.60 will take the pair to next level 159.60/160.48.

- Minor trend reversal only above 161.

- Short term bearish invalidation only above 162.60

It is good to buy at dips around 158.60-65 with SL around 158 for the TP of 159.60/160.25