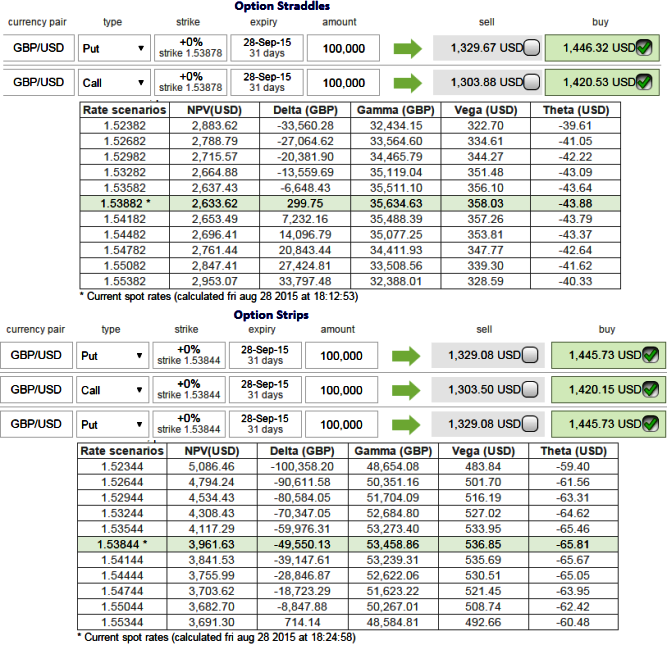

Cable is currently trading at spot 1.5377 and we are eying upon strip straddle because speculating opportunities lingering as the pair has been oscillating on either direction since last May but for now slightly downwards that this might now breakout to downside or to create a delta neutral straddle position. A comparative analysis between straddle and strips is illustrated as below.

Usually long straddle can be employed this way:

1 contract of ATM (strike 1.5387) call at $1420.53

Buy to Open 1 contract of ATM (strike 1.5387) put at $1446.32.

Net Debit = $2866.85

Overall Delta = close to zero

Maximum Profit = Unlimited

Profit = GBPUSD FX spot - Strike Price of Long Call - Net Premium Paid or Strike Price of Long Put - GBPUSD FX spot - Net Premium Paid.

Strip Straddle:

Buy to open 1 contract of ATM (strike 1420.53) call at $1420.15

Buy to open 2 contracts of ATM (strike 1420.53) Put at $1445.73.

Net Debit = $4311.61

Overall Delta = -0.49

Maximum Profit = Unlimited

Profit = GBPUSD FX spot - Strike Price of Calls - Net Premium Paid OR 2 x (Strike Price of Puts - GBPUSD FX spot) - Net Premium Paid.

Thereby, we conclude stating since downside pressure is intensifying, more profitability on strips strategy is possible than straddles with an extra cost on ATM put.

GBP/USD Option strips better over straddle on downswings

Friday, August 28, 2015 1:16 PM UTC

Editor's Picks

- Market Data

Most Popular

Bitcoin Defies Geopolitical Gravity: Institutional Inflows Fuel Bullish Rebound Toward USD 70,000

Bitcoin Defies Geopolitical Gravity: Institutional Inflows Fuel Bullish Rebound Toward USD 70,000  Crude Oil on the Cusp: Hormuz Blockade Threats Fuel 15% Rally Toward USD 85 Target

Crude Oil on the Cusp: Hormuz Blockade Threats Fuel 15% Rally Toward USD 85 Target  Why did Iran bomb Dubai? A Middle East expert explains the regional alliances at play

Why did Iran bomb Dubai? A Middle East expert explains the regional alliances at play  Does international law still matter? The strike on the girls’ school in Iran shows why we need it

Does international law still matter? The strike on the girls’ school in Iran shows why we need it  BTC Blasts +$3,500 to $66,300 High — ETF Inflows Spark Institutional Comeback, Bulls Target $75K

BTC Blasts +$3,500 to $66,300 High — ETF Inflows Spark Institutional Comeback, Bulls Target $75K  The Pentagon strongarmed AI firms before Iran strikes – in dark news for the future of ‘ethical AI’

The Pentagon strongarmed AI firms before Iran strikes – in dark news for the future of ‘ethical AI’  AI is already creeping into election campaigns. NZ’s rules aren’t ready

AI is already creeping into election campaigns. NZ’s rules aren’t ready