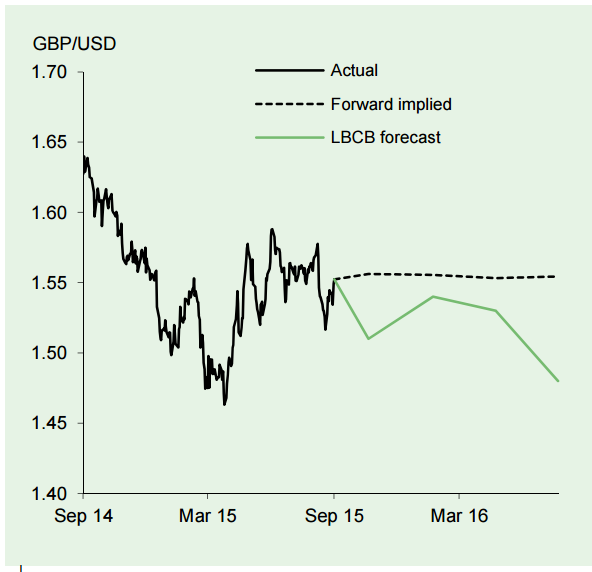

After a volatile month, GBP/USD ended much where it began, at around 1.55. Having tested support just below 1.52 in early September, the pound subsequently recovered, propelled by slightly more hawkish comments from the Monetary Policy Committee (MPC) and a general weakening of the USD. The direction GBP/USD takes from here will be heavily dependent on developments in China and the relative prospects for US and UK monetary policy.

Given the difference in tone of recent policy communications from the Fed and the MPC, it is believed that there is scope for further near-term sterling strength - especially if UK labour/wage data continue to improve.

Near term, China concerns are likely to continue to have a disproportionate impact on the USD. However, in the absence of a China-induced global shock, concerns over the UK's current account deficit, potential EU referendum risk and more acute fiscal austerity should push GBP lower in 2016.

"While we have pushed out our call for the first rise in US interest rates by three months - to December - our view that UK rates will rise in early 2016 is unchanged. We target 1.56 by year end and 1.45 by end 2016", says Lloyds Bank.

GBP/USD Outlook

Wednesday, September 23, 2015 10:26 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX