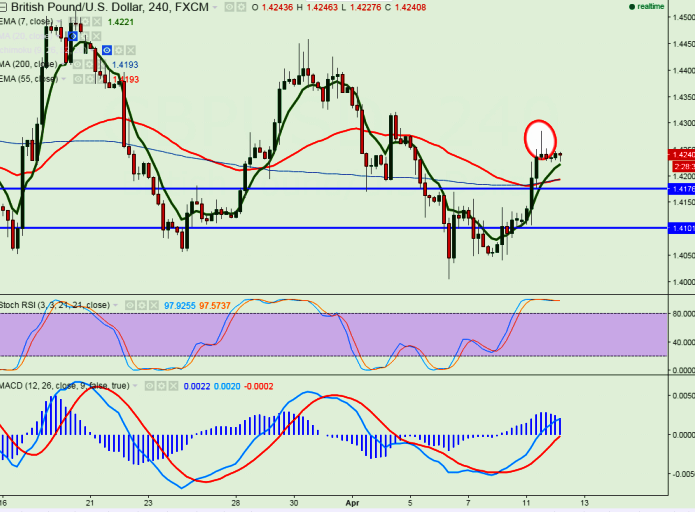

- Candle Stick pattern Formed- Gravestone Doji

- Major resistance -1.4320

- Cable has made a high of 1.42863 and declined from that level . It is currently trading around 1.42317.

- Markets eyes UK CPI data which is to be released today for further movement.

- Headline U.K CPI is expected to increase for second consecutive month and Core rate of inflation to be at 1.3% y/y opposed to Feb figure of 1.2% y/y, a first rise in 2016.

- Another uptick in headline inflation accompanied by rise in core inflation will take the cable to next level around 1.4300/1.4320.

- On the higher side pair’s major resistance is around 1.4320 and break above will take the pair till 1.4380/1.4400.

- Cable’s minor support is around 1.4170 and break below will drag the pair to lower level till 1.4100/1.4040.Overall bullish invalidation only below 1.4000.

It is good to sell on rallies around 1.4280-85 with SL around 1.4320 for the TP of 1.4170/1.4100